Is Pandora Media’s business model sustainable?

The popular Internet radio service Pandora, which revolutionized the way people listen to music, posted its highest quarterly earnings in the calendar fourth quarter 2013, since its IPO in 2011.

April 11 2014, Published 1:42 p.m. ET

The profits

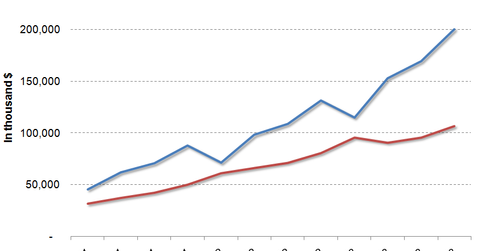

The popular Internet radio service Pandora, which revolutionized the way people listen to music, posted its highest quarterly earnings in the calendar fourth quarter 2013, since its IPO in 2011. Pandora saw a profit of $9 million, or $0.04 a share, compared with $1.6 million, or $0.01 a share, in the year-ago quarter. Revenue grew over 52% year-over-year to $200.4 million. Note that Pandora announced a shift in its fiscal year to the calendar year, effective December 2013. The EPS beat street estimates but stock fell on the disappointing first quarter 2014 guidance.

Pandora’s success in providing users with an enjoyable listening experience saw the company expanding revenues from $55 million in fiscal 2010 to $637.9 million in fiscal 2013. However, the company has struggled with delivering consistent profits. The stock lost nearly a quarter of its value following its debut until mid of last year, as investors questioned the company’s ability to generate profits amid rising content costs and fending off increasing competition. Pandora sees competition from traditional radio as well as the streaming music services launched by Apple (AAPL), Google (GOOG), Microsoft (MSFT), and Spotify. Amazon (AMZN) may enter the space as well.

Pandora needs an algorithm for profitability!

Pandora (P) generates majority revenue from advertising, and the remaining from subscription to Pandora One. However, it also pays royalties to acquire rights to copyright owners of both sound recordings and musical works to stream music content over the Internet. Analysts and critics have questioned Pandora’s business model, as an increase in listening hours leads to an increase in content acquisition costs by way of royalty payments. Pandora can only generate profits if its revenue per user increases, and that can happen only with an increased ability to monetize listener hours via ads.

In the last reported quarter, Pandora saw some progress with advertising revenue surging ahead of content acquisition costs. For the calendar quarter ended December 31, 2013, content acquisition costs rose by around 31%, while advertising revenue increased 39%, and non-GAAP subscriptions and other revenue surged by 132%. However, content acquisition costs are expected to continue to rise. Pandora’s ability to sustain and grow advertising revenues over the longer term remains a concern among investors and critics. Peer Spotify faces similar concerns due to increasing royalty payments.

Pandora’s guidance for the first quarter fell short of expectations, and shares slid 8%. The company expects a loss of $0.14 to $0.16 a share on revenue of $170 million to $176 million. For the full-year 2014, Pandora expects its revenues to be in the range of $870 million to $890 million, with mid-point of this guidance representing year-over-year growth of 36%.

The management said in the earnings release that “we will continue to aggressively invest in 2014 in sustained audience and engagement growth as well as activities that further accelerate monetization. As such, our bias will continue to be toward revenue growth and capturing additional market share.” The company expects an increase in sales and marketing expenses as it invests in expansion and new and innovative advertising products, especially for better ad targeting. “It’s not a time to try and optimize profitability,” CFO Mike Herring is said to have told Reuters.

A Morgan Stanley analyst said on the results that the company “appears to be pushing ad product innovation (programmatic buying and advanced geo-targeting were cited as potential endeavors) and may invest in marketing the service to new users now that it has greater financial flexibility to do so.”