Key points from Enterprise Products Partners’ analyst day meeting

Enterprise Products Partners (EPD) is one of the largest master limited partnerships operating in the midstream energy space.

Oct. 29 2019, Updated 8:20 p.m. ET

Enterprise Products Partners

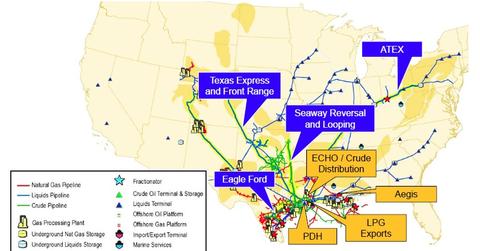

Enterprise Products Partners (EPD) is one of the largest master limited partnerships operating in the midstream energy space. The company operates a vast portfolio of energy infrastructure, storage, and transportation assets, based mostly in the U.S. EPD’s services include natural gas gathering, treating, processing, transportation, and storage; natural gas liquids transportation, fractionation, storage, and import and export terminals; crude oil gathering, transportation, storage, and terminals; offshore production platforms; and petrochemical and refined products transportation. Other major companies operating in the same sector as EPD include Targa Resource Partners (NGLS), Regency Energy Partners (RGP), Plains All American Pipeline (PAA), and Kinder Morgan Energy Partners (KMP). All of these companies are components of the Alerian MLP ETF (AMLP).

As of March 27, 2014, the company had a market cap of $64 billion, and an enterprise value of $81 billion. EPD’s revenue for LTM (the last 12 months) as of December 31, 2013, totaled $47.7 billion. Adjusted EBITDA over the same period was $4.7 billion. Distributable cash flow (or DCF) during the same period was $3.8 billion, resulting in distributable cash flow coverage (DCF divided by cash distributions paid out) of 1.5x. On January 13, 2014, EPD declared a distribution of $0.70 per unit. As of March 25, 2014, EPD’s share price was $68.89, resulting in a current yield of 4.06%.

Recently, Enterprise Products Partners (EPD) gave a major presentation updating financial analysts and investors on the current state of the company and where management expected the company to invest in the years to come. Some of the key takeaways of the presentation were the following (which we’ll elaborate on in later parts of this series):

- EPD has identified extensive growth opportunities, having completed ~$2.3 billion of projects so far in 2014, with another ~$5.5 billion of projects to be completed from now through 2016 (of which ~$2.5 billion will be completed in the remainder of 2014). EPD also has further projects identified and under development but not yet approved by the board.

- Management expects that near-term equity issuance should be minimal, as the company already engaged in several capital markets transactions over the past six months in anticipation of its capex needs and began 2014 with ~$4.1 billion of liquidity.

- Enterprise believes that the U.S. will continue to grow natural gas and oil production based on factors like “stacked plays” (the presence of multiple hydrocarbon producing layers) and lower breakeven costs.

- EPD expects that hydrocarbon (natural gas, oil, and natural gas liquids) exports will be a key lever to growth, given strong domestic production, EPD’s current asset footprint, and solid international demand. In the near term, EPD is focused on LPG (liquefied petroleum gas) exports, which include propane and butane, and much of EPD’s current export capacity has already been committed to by customers. EPD also sees significant potential for ethane exports.

- The Bakken, Permian, and Eagle Ford will continue to drive oil and liquids production, and EPD currently has significant crude oil infrastructure and logistics to profit from these trends and is in the process of growing these businesses as well. This includes working on significant crude oil terminaling and pipeline assets, mostly in the Gulf Coast, South Texas, and West Texas, that are well positioned to take advantage of crude oil flows and distributing this oil to refiners or to get the oil waterborne via docks. Plus, EPD has significant truck, rail, and barge assets for use in moving crude oil and natural gas liquids.

- EPD expects the deepwater Gulf of Mexico market to grow, and it has an offshore pipeline in the works to take advantage of this opportunity.

- Enterprise expects the Gulf Coast region to become a demand center for natural gas, given a buildout of demand from industrial sources, petrochemical companies, power generation, and exports.

- Enterprise maintains a simple financial structure, solid credit metrics, strong distributable cash flow coverage, investment-grade credit ratings, ample liquidity, and continued distribution growth.