Fannie Mae TBA securities shrug off the March FOMC meeting

Given that another $10 billion in tapering was already priced in, TBAs didn’t react to the FOMC meeting. MBS spreads tightened as MBS rallied in the face of a bond market sell-off.

Nov. 20 2020, Updated 12:04 p.m. ET

Trading in Fannie Mae TBAs

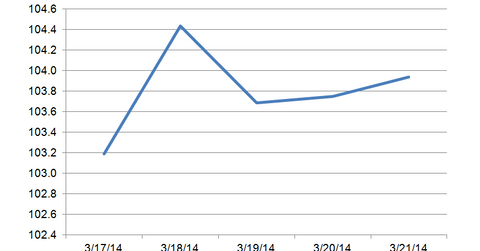

When the Federal Reserve talks about buying mortgage-backed securities (or MBS), it’s referring to the To-Be-Announced market (usually referred to as the TBA market). The TBA market allows loan originators to take individual loans and turn them into a homogeneous product that can be traded. TBAs settle once a month, and Fannie Mae loans are put into Fannie Mae securities. TBAs are broken out by coupon rate and settlement date. In the chart below, we’re looking at the Fannie Mae 4% coupon for April delivery.

The TBA market is the basis for which your loan originator prices a loan

When the originator offers a loan to you (as a borrower), your rate is par, give or take any points you’re paying. Your originator will then sell the loan into a TBA. If you’re quoted a 4% mortgage rate with no points, the lender will fund your loan and then sell it for the current TBA price. In this case, the TBA closed at 103 30/32, which means your lender will make just about 4% before taking into account the cost of making the loan. The Fed is the biggest buyer of TBA paper. Other buyers include sovereign wealth funds, countries with trade surpluses with the United States, and pension funds. TBAs are a completely “upstairs” market in that they don’t trade on an exchange and most trading is done “on the wire,” or over the phone.

TBAs shrug off the FOMC meeting

Given that another $10 billion in tapering was already priced in, TBAs didn’t react to the FOMC meeting. MBS spreads tightened as MBS rallied in the face of a bond market sell-off.

The main action driving TBAs specifically seems to be out of Washington, between the Fed purchases and the government’s policies to drive origination. We heard from a number of the biggest banks recently, and all of them reported drops in origination volume of 30% to 40% in the fourth quarter.

Implications for mortgage REITs

Mortgage REITs and ETFs such as Annaly (NLY), American Capital (AGNC), Capstead Mortgage (CMO), the iShares 20-year bond ETF (TLT), and the Mortgage REIT ETF (MORT) are the biggest beneficiaries of quantitative easing, as quantitative easing helps keep REITs’ cost of funds low and they benefit from mark-to-market gains. This means their existing holdings of mortgage-backed securities are worth more as the TBA market rises. The downside is that interest margins compress going forward, because yield moves inversely with price. Also, as MBS rally, prepayments are likely to increase, which negatively affects mortgage REITs.

As a general rule, a lack of volatility is good for mortgage REITs because they hedge some of their interest rates risk. Increasing volatility in interest rates increases the cost of hedging. This is because as interest rates rise, the expected maturity of the bond increases, as there will be fewer prepayments. On the other hand, if interest rates fall, the maturity shortens due to higher prepayment risks. Mechanically, this means they must adjust their hedges and buy more protection when prices are high and sell more protection when prices are low. This “buy-high, sell-low” effect is called “negative convexity,” and it explains why Fannie Mae MBS yield so much more than Treasuries.

While Fannie Mae mortgages don’t have an explicit government guarantee, they are “government-sponsored” and considered to be guaranteed by the government. That said, Ginnies and Fannies do trade at a spread to each other, with Ginnies trading at a premium because of their explicit government guarantee.