Why some companies may “prefer” to issue preferred equity

Companies may prefer to raise money through preferred equity for a few reasons. One possible benefit to issuing preferred equity is to reach a new pocket of investors

Nov. 22 2019, Updated 5:53 a.m. ET

Preferred equity

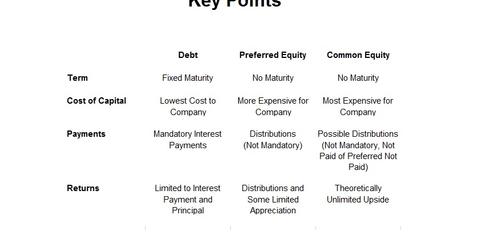

Companies may prefer to raise money through preferred equity for a few reasons. One possible benefit to issuing preferred equity is to reach a new pocket of investors, such as funds specializing in preferred equity. Another reason is that preferred equity is one way to maintain debt metrics (such as leverage and debt-to-cap) below a certain threshold while still raising money, and not diluting common equity shareholders (note, though, that rating agencies can sometimes treat a portion of preferred equity as debt, due to some debt-like features).

Plus, preferred equity isn’t like debt in that it has no maturity—unlike bonds, which companies must constantly refinance. Also, because preferred equity sits higher than common equity in the capital structure, the “cost of capital” using common stock should theoretically be lower.

Note that because the preferred stock sits lower than debt in the capital structure, it should be more expensive than debt (that is, more expensive for the company to obtain preferred equity financing than debt financing from a rate perspective). It’s also not like debt in that it’s not required to make distributions (whereas interest payments are obligations). Atlas Pipeline Partner’s prospectus supplement offering its preferred equity states:

- “We cannot assure you that we will be able to pay distributions regularly, and our ability to pay distributions may be limited by agreements governing our indebtedness and cash distribution requirements under our limited partnership agreement.

- “Our limited partnership agreement requires that, within 45 days after the end of each quarter, we distribute all of our available cash (as defined in our limited partnership agreement) to unitholders of record on the applicable record date. As a result, we do not expect to accumulate significant amounts of cash. Depending on the timing and amount of our cash distributions, these distributions could significantly reduce the cash available to us in subsequent periods to make payments on the Class E Preferred Units.

- “In addition, we are party to agreements which would prohibit or have the effect of prohibiting the declaration, payment or setting apart for payment of distributions following the occurrence and during the continuance of a default or event of default under such agreement. Furthermore, our revolving credit facility and the indentures governing our Senior Notes restrict or prohibit our ability to make distributions on our Class E Preferred Units under the circumstances described in “Description of Class E Units—Distribution Limitations.” In the future we may become party to other agreements which restrict or prohibit the payment of distributions. We will not declare distributions on our Class E Preferred Units, or pay or set apart for payment distributions on our Class E Preferred Units, if the terms of any of our agreements, including any agreement relating to our debt, prohibit such a declaration, payment or setting apart for payment or provide that such declaration, payment or setting apart for payment would constitute a breach of or default under such an agreement.”

Investor considerations

For investors considering investing in preferred equity, such as that recently issued by Atlas Pipeline Partners (APL) or Vanguard Natural Resources (VNR), there are several factors to consider.

The pros to investing in preferred stock are that it’s senior to common equity in the capital structure, so it’s theoretically less risky. Plus, preferred stock has a fixed distribution that’s paid out before common equity. However, preferred stock has limited upside, as the distributions are fixed, and investors don’t have an enforceable right to distributions (unlike bondholders and interest payments). Note that because of how the cash flows are structured (fixed cash flows over a time period with no maturity), preferred stock acts like a perpetuity. In this case, the theoretical value of the preferred stock is simply the cash payment (which is fixed) over the appropriate discount rate. In the case of APL, the par value of the stock at issuance was $25, the discount rate is 8.25%, and the annual payment is $2.06.

- $25 = $2.06 / 8.25%

However, if interest rates in general rise (which should also increase the appropriate discount rate for APL), with a fixed distribution payment, the value of the stock should decrease. This means that preferred stock can be especially sensitive to interest rates. Common equity should theoretically be less sensitive to rate movements, as common equity holders aren’t limited to fixed distributions, but have more upside in their investment.

It’s also possible to invest in preferred stock in general as an investment class without undertaking specific company risk through purchasing shares in a preferred stock ETF such as the iShares S&P US Preferred Stock Index Fund (PFF), the PowerShares Preferred Portfolio (PGX), and the SPDR Wells Fargo Preferred Stock ETF (PSK).

To learn more about investing in MLPs, see Why rising frac spreads are benefitting select MLP names.