How MLPs profit from natural gas gathering and processing

Natural gas gathering and processing are a significant part of the operations of many midstream master limited partnerships.

March 13 2014, Updated 10:45 a.m. ET

Natural gas gathering and processing

Generally, natural gas gathering and processing providers enter into contracts with the producers of natural gas (names such as Chesapeake Energy or Range Resources). The most common contract structures are as follows:

- Fee-based: With fee-based contracts, the G&P provider is usually paid a fixed fee per amount of volume that flows through. Fee-based contracts don’t have direct commodity price sensitivity. However, G&P names could be subject to indirect commodity price sensitivity if sustained low natural gas prices cause volumes to decline, thereby negatively affecting revenues.

- Percent-of-proceeds or percent-of-liquids: With percent-of-proceeds or “POP” contracts, the G&P provider processes the natural gas, sells the residue gas and natural gas liquids, and is paid depending on one of the following:

- A percentage of the actual sale proceeds

- A percentage of what sale proceeds would be based on certain index prices

- A percentage of the proceeds from the sale of the natural gas liquids (percent-of-liquids or “POL”). Under this contract, G&P providers have sensitivity to both commodities (inherently long natural gas or natural gas liquids) and volumes.

- Keep-whole: With keep-whole contracts, the G&P provider generally retains the natural gas liquids as payment but must return them to the producer either enough natural gas (or the cash equivalent) to make the producer “whole” for the energy value of the NGLS removed. Under these contracts, G&P providers are inherently long natural gas liquids and short natural gas, and they’re exposed to volume fluctuations.

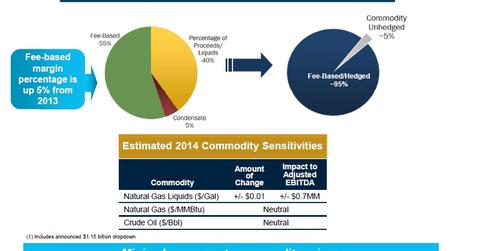

Over recent years, the gathering and processing industry has moved towards more and more fee-based contracts in an attempt to minimize commodity price sensitivity. For example, Access Midstream (ACMP) notes that its business is 100% fixed-fee revenues. Enterprise Products (EPD) noted in its latest 10-K, “We attempt to mitigate any commodity price exposure through our hedging activities as well as through converting keepwhole and similar contracts to fee-based arrangements.”

A common trend in the midstream space has also been for companies to tout how much of their earnings are “fee-based” as shown in the above excerpt from a presentation from DCP Midstream (DPM) and Atlas Pipeline Partners (APL).

Note that the Alerian MLP ETF (AMLP) holds numerous companies involved in natural gas gathering and processing.