Why Third Point initiated a position in Williams Companies

Third Point started a new 2.83% position in gas pipeline operator Williams Companies, Inc.

Feb. 27 2014, Published 5:26 p.m. ET

Activist investor Dan Loeb’s Third Point started a new 2.83% position in gas pipeline operator Williams Companies, Inc. (WMB). Shares of the company were up in December after Keith Meister’s Corvex Management L.P. and Eric Mandelblatt’s Soroban Capital Partners LLC together disclosed a 5.3% stake in Williams Companies via a 13D filing.

The filing said that Williams “has a strong competitive position in an attractive industry with tremendous growth opportunities but recent operational and financial missteps have prevented the Issuer (Williams)’s shares from reflecting full value.” The filing further said the hedge funds intend to discuss “enhancing the structure and value of the Williams’ investments and assets; evaluating and financing of capital projects; optimizing the the company’s capital structure and dividend policy; improving the operational and financial execution; and the potential for participating in strategic combinations given the rapid pace of consolidation in the midstream energy industry.”

Plus, the hedge funds had discussions with Williams’ management and board, proposing to immediately add Meister and Mandelblatt to the board. The hedge funds believe Meister and Mandelblatt’s industry knowledge and expertise will “assist Williams in capturing the full scale of the significant value creation opportunity that lies ahead and their appointment would materially enhance shareholder ownership on the Board.”

A filing last week revealed that the hedge funds have further increased the stake and collectively own 8.78% stake in Williams, valued at $2.5 billion. The filing added that Corvex and Soroban have retained Ken Moelis’ firm Moelis & Company LLC to serve as the financial advisor in connection with the investment.

For fourth-quarter 2013, Williams reported a net loss of $14 million, or $.02 per share on a diluted basis, compared with net income of $149 million, or $0.23 per share in the year ago period. The decline was primarily due to Williams Partners’ Geismar olefins plant being out of service for the entire fourth quarter and a decrease in NGL margins. The petrochemical plant in Louisiana saw an explosion in June of last year and is expected to remain out of service until June of this year. The 4Q results were also impacted by a $99 million of tax expense on undistributed foreign earnings related to the planned dropdown of the company’s Canadian operations to Williams Partners, which is expected to close by the end of February 2014. Williams owns approximately 64% of Willams Partners (WPZ), one of the largest diversified energy master limited partnerships.

In January 2014, Williams declared a quarterly dividend of 0.4025 per share. This represents a $1.61 dividend on an annualized basis and a yield of 4.10%. The company said in its earnings release, “We increased our full-year dividend to shareholders by 20% and we expect strong cash flow growth from Williams Partners and Access Midstream Partners to drive this level of annual dividend growth through the 2014 to 2015 guidance period.” The company expects its fiscal 2014 adjusted EPS in the range of $1.00 to $1.20.

Williams’ operations overview

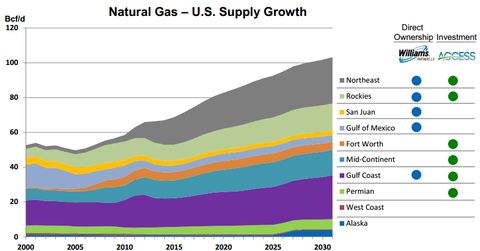

Williams operates three natural gas transmission pipelines. Together, these pipelines deliver approximately 14% of the natural gas consumed in the U.S. The Transco pipeline system provides natural gas to the northeastern and southeastern states. The Northwest Pipeline system is a primary artery for the transmission of natural gas to the Pacific Northwest and Intermountain Region. Gulfstream is a partnership between Williams, Spectra Energy, and their respective affiliates. The 745-mile pipeline delivers clean-burning natural gas across the Gulf of Mexico to meet Florida’s rapidly growing residential and power needs.

Williams’ large-scale midstream operations in the U.S. include natural gas gathering, processing and storage; natural gas liquid (NGL) production and transportation; and oil transportation. Areas of operation in the U.S. include the West, onshore and offshore Gulf of Mexico, and the Marcellus Shale. Williams also has a growing midstream business in Canada focused on processing oil sands off-gas into NGLs and olefins. The proposed Bluegrass pipeline project will transport natural gas liquids from the Marcellus and Utica shale producing areas in Pennsylvania, West Virginia, and Ohio to the developing petrochemical market in the Northeast U.S., as well as the rapidly expanding petrochemical and export complex on the U.S. Gulf Coast.