Hertz Global Holdings Inc

Latest Hertz Global Holdings Inc News and Updates

Hertz Reaches a Car Theft Settlement in the Millions

Hertz has reached a car theft settlement over pending claims of false vehicle theft reports. Here's how many people will be affected.

When Will Hertz Stock Relist on a Major Stock Exchange?

After Hertz filed for Chapter 11 bankruptcy, the stock got booted onto the OTC market. But Hertz is back, and it's coming for a major stock exchange.

What Happened to Hertz Stock? Impressive Rebound After Bankruptcy

More than a year after the bankruptcy filing, Hertz stock is beginning to rebound. What caused the stock to rise? What can investors expect?Financials Moore Capital lowers its stakes in JPMorgan Chase

JPMorgan’s latest 2Q14 results beat estimates. Meanwhile, net income was down to $6 billion from $6.5 billion in 2Q13. The earnings per share (or EPS) was $1.46, compared to $1.60 in 2Q13.

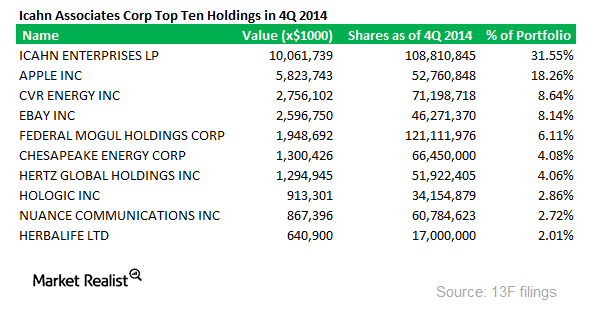

Analyzing Icahn Associates’ 13D and 4Q14 13F Filings

Icahn Associates’ 4Q14 positions were disclosed through a 13F filing in February. The size of the US long portfolio was down to $31.89 billion.

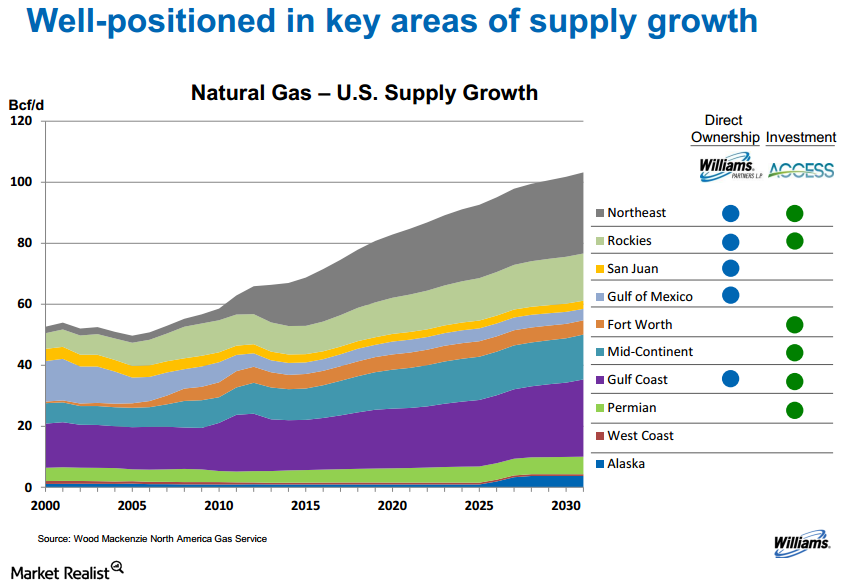

Why Third Point initiated a position in Williams Companies

Third Point started a new 2.83% position in gas pipeline operator Williams Companies, Inc.