Must-know business overview: Targa Resources Partners

Targa Resources Partners LP (NGLS) is a master limited partnership operating in the midstream energy space. Targa Resources Corp. (TRGP) is the general partner of NGLS.

Dec. 6 2014, Updated 3:17 a.m. ET

Targa Resources Partners LP

Targa Resources Partners LP (NGLS) is a master limited partnership that owns and operates a diversified portfolio of energy assets in the midstream space. The company offers services in the gathering and processing of natural gas, natural gas liquids (or NGLs), and crude oil and storing, terminaling, and selling of refined petroleum products. Targa Resources Corp. (TRGP) owns a 2% general partner interest in NGLS.

Segment overview

NGLS has two operating divisions:

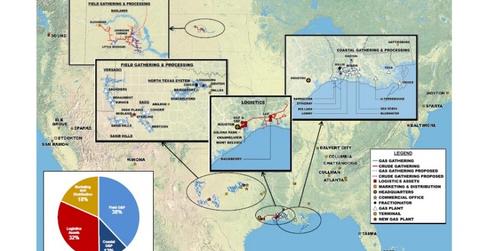

- Gathering and Processing

- Logistics and Marketing.

The Gathering and Processing division is involved in gathering, compressing, dehydrating, treating, conditioning, processing, and marketing natural gas as well as gathering crude oil. This division has two sub-divisions: Field Gathering and Processing plus Coastal Gathering and Processing. This division gathers and processes natural gas from the Permian Basin in West Texas and Southeast New Mexico, the Fort Worth Basin, including the Barnett Shale, in North Texas, and the Williston Basin in North Dakota as well as from the onshore region of the Louisiana Gulf Coast and the Gulf of Mexico. The division’s assets comprise approximately 11,300 miles of natural gas pipelines.

The Logistics and Marketing division processes natural gas liquid (or NGL) products, provides value-added services (including fractionating, storing, terminaling, transporting, distributing, and marketing NGLs and NGL products), stores refined petroleum products and crude oil, and supplies and markets natural gas. This division has two sub-divisions: Logistics Assets plus Marketing and Distribution. The Logistics segment’s assets are located at Mont Belvieu and Galena Park, near Houston, Texas, and in Lake Charles, Louisiana. The Marketing and Distribution segment has terminal facilities in Texas, Louisiana, Arizona, Nevada, California, Florida, Alabama, Mississippi, Tennessee, Kentucky, New Jersey, and Washington. The Logistics and Marketing division owns or operates 39 storage wells with a storage capacity of approximately 64 million barrels. It also owns railcars, transport tractors, and NGL barges.

As of March 31, 2014, NGLS had crude oil gathering and processing capacity of 74.7 thousand barrels per day, a plant natural gas inlet of 2.04 billion cubic feet per day, NGL production of 142.8 thousand barrels per day, export volume of 115.6 thousand barrels per day, and NGL sales of 401 thousand barrels per day.

As of May 6, 2014, NGLS had a market capitalization of $6.9 billion and enterprise value of $9.5 billion. For the last 12 months ending March 31, 2014, NGLS recorded revenues of $9.5 billion and EBITDA of $7671.7 million. Distribution per unit declared on April 15, 2014, was $0.76 per unit, or $3.05 annualized. This amounts to a distribution yield of 4.9% for a stock price of $61.93 as of May 5, 2014. In comparison, the Alerian MLP ETF AMLP’s current yield is ~6%.

Targa Resources Partners LP (NGLS) is a master limited partnership operating in the midstream energy space. Targa Resources Corp. (TRGP) is the general partner of NGLS. Other major companies operating in this sector whose earnings investors should follow include Kinder Morgan Energy Partners LP (KMP), MarkWest Energy Partners LP (MWE), and Targa Resources Corp. (TRGP). NGLS is also part of Alerian MLP ETF (AMLP) and the Yorkville High Income Infrastructure MLP ETF (YMLI).