Why high valuation and coffee prices drove Starbucks down ~13%

As store count grew over the past few years, Starbucks’ forward P/E valuation metric also expanded. What used to be just 17x gradually grew to roughly 27x, a 58% based solely on expansion in the valuations.

Nov. 20 2020, Updated 3:36 p.m. ET

Rising valuation multiple

As store count grew over the past few years, Starbucks’ forward P/E valuation metric also expanded. What used to be just 17x gradually grew to roughly 27x—a 58% increase based solely on expansion in the valuations. This could have been driven by an increase in the market’s overall appetite for returns, but the S&P 500’s forward P/E multiple went through a trough over the same period (not shown for simplicity).

Overvalued Starbucks

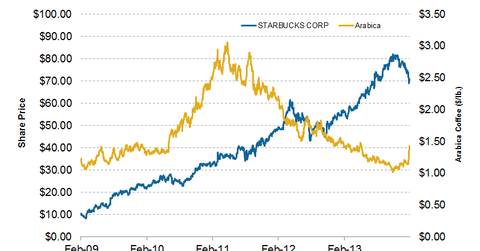

You could say the sell-off that began at Starbucks in December 2013 was driven by an overvalued stock price (see the chart above). This happened before, in 2012, when the forward P/E spiked from 25x to 30x. The market’s willingness to trade Starbucks at such a high valuation was in part driven by a short-term peak and excitement in the stock market, a reminder that the stock market’s overall sentiment has significant influence over individual stocks. But also note that Starbucks continued to climb higher after September 2013, even though valuation hit the upper trend. This time around, Starbucks had also pulled back much earlier than the market.

Coffee price

It seems the decline we’ve seen in Starbucks’ shares has lagged the recent rebound in coffee price (see above). While higher coffee prices could be passed onto consumers, they will be limited. As higher coffee prices would hurt Starbucks’ earnings growth, the market could be assigning a lower P/E multiple based on uncertainties regarding the impact of coffee prices on earnings two and three years down the road.

A consistently high forward P/E in late 2013 could have been attributed to falling coffee prices as well. As long as coffee prices fell, the market expected them to continuously support Starbucks two or three years down the road. So investors were willing to pay for a premium. But when coffee prices fell, these thoughts evaporated. Investors should note that higher coffee prices don’t mean Starbucks’ earnings and share prices won’t grow, as evidenced by the rise throughout 2011. On a comparative basis, Starbucks looks cheap compared to Chipotle (CMG), McDonald’s (MCD), Dunkin’ (DNKN), and Panera (PNRA).

Forward guidance

For the full year (fiscal year 2014), management expects Starbucks’ EPS to benefit roughly $0.09 to $0.10 from lower coffee costs. Given where the market is right now, the overall impact of coffee prices is expected to remain positive in fiscal 2015. For the second half of this year, the company expects growth of ~20% in EPS on an adjusted basis, driven by lower coffee prices mentioned earlier, revenue growth of 10% or greater, global comparable store sales growth in mid-single digits, operating margin expansion at ~1.5% to 2.0%, and 1,500 net new stores worldwide.

Note: Starbucks is part of the PowerShares Dynamic Food & Beverage ETF (PBJ).

To learn more about Starbucks’ competitor Dunkin’ Brands, see the Market Realist series Business overview: An investor’s guide to Dunkin’ Brands Group.