All oil is not created equal – why differences in crude matter (part II)

Differences in crude’s density, sulfur content, and production location can vastly affect the price which it commands on the market.

Nov. 21 2019, Updated 9:00 p.m. ET

Sulfur content

Crudes also vary in the amount of sulfur they contain. Higher sulfur content reduces the value of crude as the sulfur replaces energy rich molecules. Additionally, sulfur is damaging to oil pipelines and tanks; it also creates pollution when burned. The industry uses the term “sweet” to denote crude low in sulfur, and “sour” to denote crude high in sulfur.

| Crude Oil Sulfur Content and Classification | |

| Sour | Sulfur level over 0.5% |

| Sweet | Sulfur level under 0.5% |

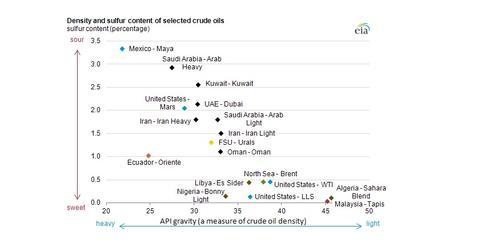

The U.S. benchmark (WTI) crude has a sulfur content of ~0.24% and the international benchmark (Brent) crude has a sulfur content of ~0.37%. The above chart from the U.S. Energy Information Administration (EIA) displays different crude grades from around the world and their respective sulfur content and API gravity figures.

According to the EIA, the proportion of sour crude production around the world had been increasing over the past two decades or so, which had prompted refining capacity additions for heavy, sour crude in the U.S. However, more recently, due in great part to the U.S. shale oil boom, there has been a rapid increase in the domestic production of light crudes.

The influx of light sweet production has struggled to find a home among U.S. refining capacity, especially in the Gulf Coast where most refinery additions were geared towards heavier, sourer crudes. The below graph shows the average annual sales price of crude by gravity, and one can see that lighter crudes used to sell at significant premiums to heavier crude. However, that dynamic changed with the supply surge of light crude, and lighter grades now sell at a discount.

The EIA noted in a recent publication that, given this dynamic, “Refining capacity in the Gulf Coast has large secondary conversion capacity including hydrocrackers, cokers, and desulfurization units. These units enable the processing of heavy, high sulfur (sour) crude oils like Mexican Maya that typically sell at a discount to light, low sulfur (sweet) crudes like Brent and Louisiana Light Sweet. Many East Coast refineries have less secondary conversion capacity, and in general they process crude oil with lower sulfur content and a lighter density. This lighter, lower sulfur crude oil commands a premium price on world markets. In recent years, crude production has risen dramatically in Canada (heavy, sour crude) and the United States (high-quality light, sweet crude), providing these types of oil to U.S. refiners. The new U.S. production often sells at a discount to poorer quality crudes because of storage and transportation constraints. Refineries across the country are developing strategies to acquire the new domestic crude streams to replace more expensive imports of high-quality crude oil. Gulf Coast refiners are also seeking more access to Canadian crudes to replace declining supplies of heavy, sour crudes from Mexico and Venezuela (Venezuelan crudes, while heavy, tend to have lower sulfur content than Maya).”