ALL

ECONOMY & WORK

NEWS

'Shark Tank' judge Mark Cuban invests big money in company that sells desserts made of hummus

The sharks did not expect the product to taste as good as it did, considering what it was made from.

5 hours ago

'Antiques Roadshow' guest finds out his textile collection that he saved from trash is worth a fortune

The designer was also commissioned by top brands and worked for the royal family.

6 hours ago

'Family Feud' host Steve Harvey stunned as player's 'koala' answer had nothing to do with the question

The host had a look of bewilderment on his face which was absolutely hilarious.

7 hours ago

'Antiques Roadshow' guest brought a rare copy of 'The Hobbit' and was stunned to hear its real value

According to the expert, personal letters and a signature from Tolkien himself added to the value of the book.

8 hours ago

'Wheel of Fortune' fans stunned by identical twins who worked together perfectly to win $88,000

Chistina and Katie Currie won over $88,000 in cash and two exotic vacations with their stunning performance.

9 hours ago

'Shark Tank' contestant taunts Kevin O'Leary for being bald — still ended up getting a $75,000 deal

Things did not seem to be going well for the entrepreneur due to her high energy.

10 hours ago

'Pawn Stars' guest holds her head in disbelief after her US President footage was not an 'original'

The guest might have had high expectations, but they were quickly brought down to earth.

11 hours ago

'Price is Right' player wins the show's toughest game with the help from her husband in audience

The contestant was unable to contain her excitement and hugged the model.

1 day ago

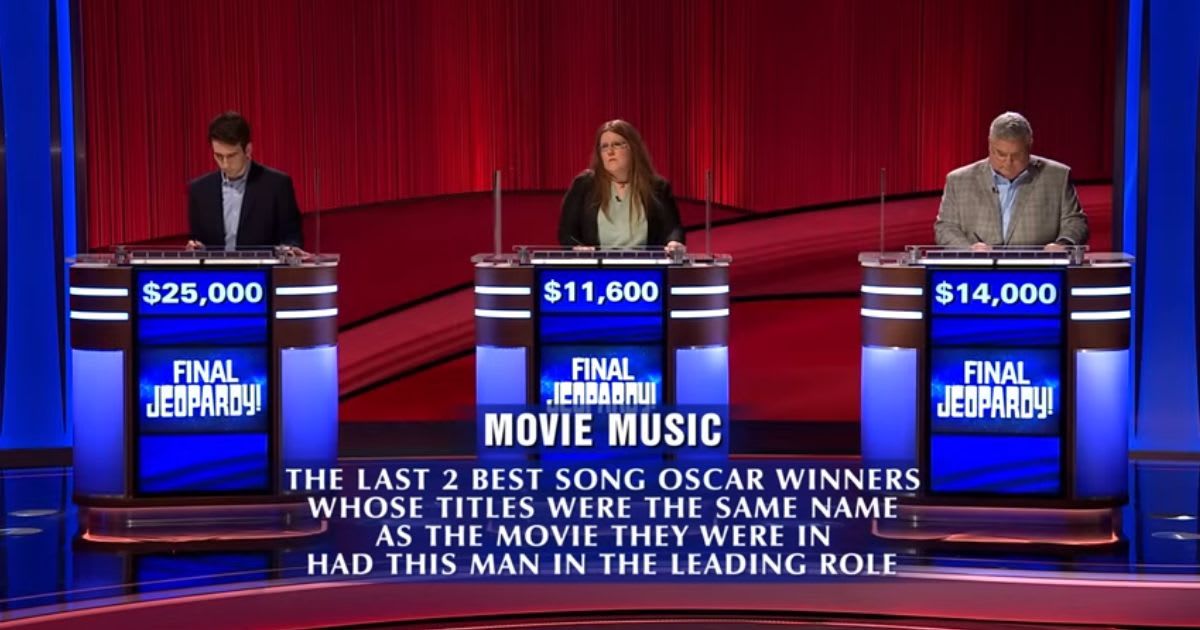

'Jeopardy' contestant fails to decode clue about James Bond — but fans think it was 'confusing'

Two of the players got it right, and while the player who lost didn't mind, fans were not satisfied.

1 day ago

'Shark Tank' contestant makes judges smell dirty diapers — still gets $75,000 deal from Mark Cuban

After everyone backed out, the billionaire Shark stepped up to help the founder of Diaper Dust.

1 day ago

'Price is Right' contestant wins a brand new car — turns out, it was also her 50th birthday

Lisa celebrated her birthday in style with a perfect two-card guess to win the big prize.

1 day ago

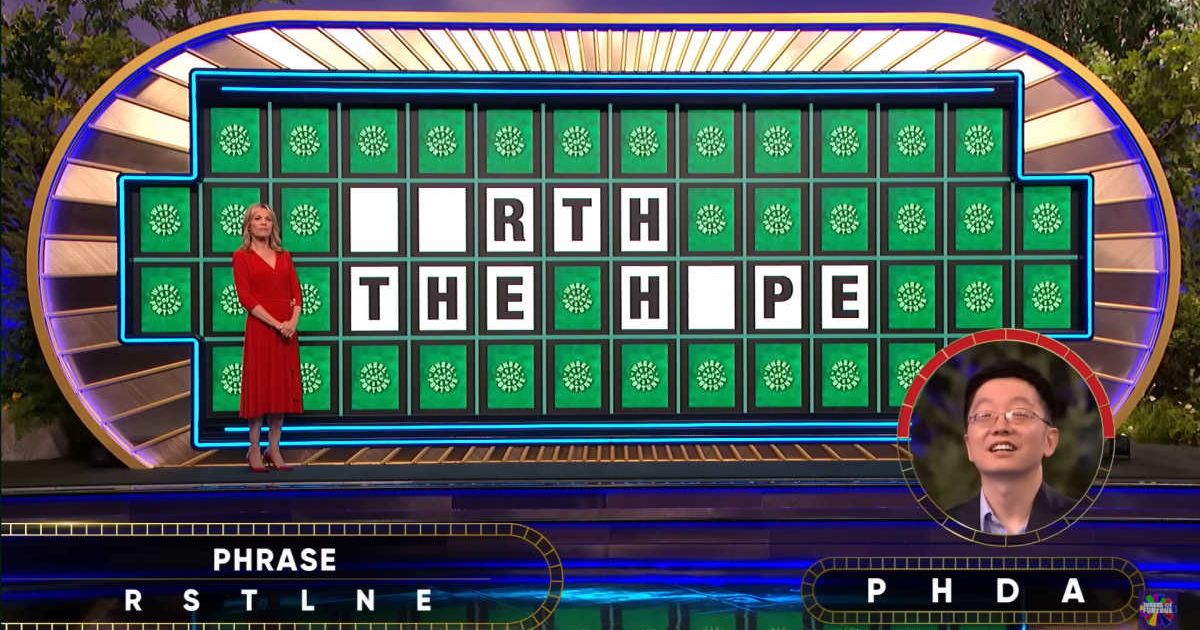

'Wheel of Fortune' contestant comes close to winning a car — but lost out because of one letter

Sun kept repeating the incorrect phrase but couldn't identify the error in time.

1 day ago

'Pawn Stars' guest was stunned to learn his NASCAR item was a fake — but Rick Harrison consoles him

Rick Harrison did what he could to console the guest who said that he had lost faith in NASCAR.

1 day ago

'Shark Tank' contestant gets $500,000 deal from judges who teamed up to push Kevin O'Leary out

After almost closing a deal with Mr Wonderful, the founder of 'Simply Good Jars' pivoted hard.

1 day ago

'Family Feud' host Steve Harvey couldn't control himself after hearing player's OJ Simpson answer

The host thought it was the "worst possible answer" to give even as the team felt it was good enough.

2 days ago

'Antiques Roadshow' guest says 'wow, that's crazy' after hearing the value of his 125-year-old device

Both the guest and the expert were fascinated by how well the automaton worked.

2 days ago

'Shark Tank' judges fight it out over a deal with elderly couple who brought a unique flashlight

One of the entrepreneurs broke down in tears, explaining all the struggles they had to go through.

2 days ago

'Pawn Stars' boss Rick Harrison feels $100,000 is too much for desk linked to Lincoln's assassination

Adding to the controversy, the owner of Dr. Mudd's lapdesk asked Harrison for $100,000.

2 days ago

'Wheel of Fortune' player wins $40,000 after solving a tough puzzle — with just a second to spare

With just milliseconds to spare, Sarah LaPilusa pulled off an incredible Bonus Round win.

2 days ago

‘Antiques Roadshow’ guest says 'oh my goodness' after expert revealed the value of her 1884 doll

She couldn’t believe it when her doll was appraised at a five-figure sum, and laughed in disbelief.

2 days ago