What Wall Street Analysts Are Recommending for Halliburton

On September 5, 2017, 89.0% of Wall Street analysts who are tracking Halliburton stock rated it a “buy” or some equivalent.

Sept. 11 2017, Updated 7:36 a.m. ET

Wall Street’s recommendations for Halliburton

Let’s take a look at what Wall Street analysts are recommending for Halliburton (HAL) stock as of September 5, 2017.

Analysts’ ratings for Halliburton

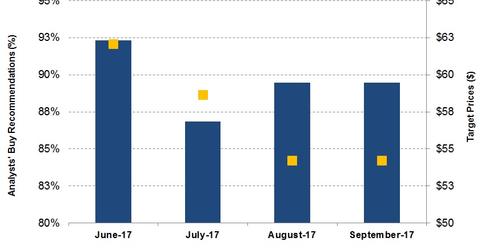

On September 5, 2017, 89.0% of Wall Street analysts tracking Halliburton stock rated it a “buy” or some equivalent. Approximately 8.0% have rated it a “sell” or some equivalent, while the remaining 3.0% have recommended a “hold.” By comparison, 33.0% of the sell-side analysts tracking Key Energy Services (KEG) rated it a “buy” or some equivalent on September 5, 2017, while 67.0% rated it a “hold.”

Analysts’ rating changes for HAL

From June 5, 2017, to September 5, 2017, the percentage of analysts recommending a “buy” or some equivalent for HAL has fallen from 92.0% to 89.0%. Analysts’ “hold” recommendations have increased during the same period. A year ago, 85.0% of the sell-side analysts recommended a “buy” for HAL. Halliburton makes up 2.2% of the iShares North American Natural Resources (IGE), which has risen 12.0% in the past year compared to a 9.0% fall for HAL stock.

Analysts’ target prices for HAL and its peers

Wall Street analysts’ mean target price for HAL on September 5, 2017, was $54.20. HAL is currently trading at $39.80, implying a 36.0% return potential at its current median price. A month ago, analysts’ average target price for HAL was the same.

The mean target price surveyed among sell-side analysts for TechnipFMC (FTI) is $33.70. FTI is currently trading at $26.60, implying a 27.0% upside at its average target price. The mean target price surveyed among sell-side analysts for NCS Multistage Holdings (NCSM) is $29.90. NCSM is currently trading at $20, implying a 50.0% upside at its mean target price.

You can find out more about the OFS (oilfield services and equipment) industry in Market Realist’s The Oilfield Equipment and Services Industry: A Primer.