New China Is All about Technology

One of the biggest trends in the global economy over the past two years is the reduction in manufacturing capacity in China (FXI) (MCHI).

Dec. 4 2017, Updated 2:33 p.m. ET

VanEck

BUTCHER: How does China fit in and what is happening there? Where do you see the opportunities there?

“New China” Passes “Old China”

VAN ECK: Coming into the year we talked about Old China. There had been a tremendous growth in capacity for steel and all other sorts of basic industries in Old China. This was causing a great deal of trade tension with the U.S. (with the Trump election) and with Europe. Xi Jinping has now been confirmed for another term in office. He has been applying the brakes to Old China and reducing capacity. Luckily there has been no sort of immediate trade war between the U.S. and China. Basically the country is aligned with our interests in reducing Old China capacity through what they call supply side reforms. We believe this is excellent. It means that China’s traditional supply chain will begin to compete on a fairer economic basis with other countries.

The upside change in China has been the emergence of New China, we all know about Alibaba’s technology for example. That has, first of all, been reflected in the Chinese economy. Growth has been higher than people thought. But more importantly, the stock market in China has turned completely upside down: technology is now the largest sector. It is over 30% of the equity markets. Energy and financials, for example, have become less important. What people have been talking about for 10 years has finally happened. The big switch happened in 2017, New China is now emergent over Old China.

Market Realist

Supply-side reforms in China

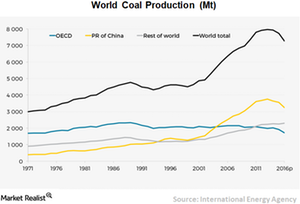

One of the biggest trends in the global economy over the past two years is the reduction in manufacturing capacity in China (FXI) (MCHI). The country is a major player on the world’s manufacturing stage since it produces nearly half of the world’s coal, steel, aluminum, and cement. China curtailed 290 million metric tons of coal capacity and 65 million tons of iron and steel capacity in 2016, while in the first half of this year, 110 million tons of coal and 42 million tons of steel and iron production capacity were curtailed. China (GXC) believes that capacity reduction should lead to improving profitability and healthier balance sheets for companies in the basic industries.

Developed markets to benefit

Capacity reduction in China is a positive factor for global industry. In the past, many US (SPY) (IVV) and European companies have accused China of dumping their markets with cheap metals, hurting domestic industries. The supply-side reforms in China could benefit the basic industries in developed markets.

Dominance of technology companies

Technology is playing a key role in the rapid development of new industries like e-commerce, artificial intelligence, and data analytics. Over the last decade, China (KWEB) has decisively moved from an imitator of technology to one of the biggest innovators with many large companies operating in the country. In the MSCI Emerging Markets Index, out of the top ten companies, six are from China, and out of those, three are from the technology space. Moreover, 40.4% of the companies in the MSCI China Index are from the technology sector. Financials, which is in the second spot, is way behind with a weight of 23.2%, while energy has a weight of 4.7%.