How the Bank of Japan Could Have an Impact on the Yen This Week

For the week ended December 15, the Japanese yen (FXY) closed at 112.58 against the US dollar (UUP), appreciating by 0.79%.

Dec. 21 2017, Updated 9:00 a.m. ET

Japanese yen appreciated against the US dollar

The Japanese yen (JYN) appreciated against the US dollar as the latter struggled to gain from the Federal Reserve’s recent rate hike. There were no major developments on the domestic front, and the price action of the Japanese yen was influenced by demand for the US dollar.

For the week ended December 15, the Japanese yen (FXY) closed at 112.58 against the US dollar (UUP), appreciating by 0.79%.

Japanese equity markets (EWJ) depreciated in the previous week as the Nikkei 225 (JPXN) posted a weekly loss of ~1.1% for the week ended December 15.

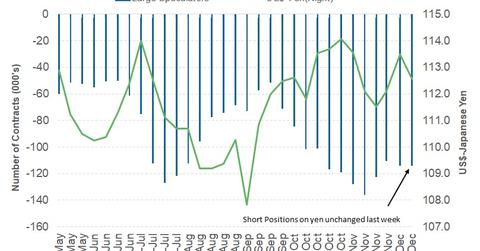

Speculators’ positions remain unchanged

According to the December 15 Commitment of Traders (or COT) report, the Japanese yen’s (YCL) speculators retained their net short positions on the yen. On Tuesday, December 12, speculators on the Japanese yen decreased their net short position from 114,267 contracts to 114,123 short contracts in the previous week.

The focus of these traders appears to be on the Bank of Japan’s (or BOJ) policy statement and the developments in the US tax reform bill.

Could the BOJ statement impact the yen?

This week, the major event for the yen is the BOJ policy statement. There are no expectations for any changes to policy or the BOJ’s accommodative “QQE with yield curve control” program.

The key focus would be on the post-policy statement and comments from Haruhiko Kuroda, the governor of the Bank of Japan. Traders will watch for his comments about the recent speculation about the BOJ scaling back its stimulus program.

Apart from the BOJ meeting, Japan reports its November export data, which is expected to improve as global demand improved in the previous month.