Why General Electric Is Focusing on Industrials?

Originally incorporated in 1892, General Electric is one of the largest and most diversified industrials and financial services corporations in the world.

Feb. 9 2016, Published 6:52 p.m. ET

GE’s background and business

Originally incorporated in 1892, General Electric Company (GE) is one of the largest and most diversified industrials and financial services corporations in the world. The company currently serves customers in approximately 175 countries and employees approximately 305,000 people worldwide.

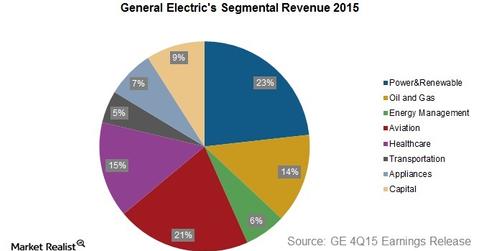

General Electric operates in two broad divisions: Industrial Businesses and Financial Services. These divisions contributed around 91% and 9%, respectively, to the company’s consolidated revenues for 2015.

Under its Industrial division, which has seven segments, GE provides products and services across power and water, oil and gas, energy, aviation, healthcare, transportation, and appliances and lighting. Through GECC (GE Capital Corporation), GE conducts its financial services business (XLF).

GE is undergoing a transformation

GE has a strategy to achieve 75% of its operating EPS from its industrial business segment (XLI) in fiscal 2016. As part of this initiative, GE has spun-off from Synchrony Financial (SYF) as a stand-alone unit and is also downsizing GECC by selling assets and portfolios to third parties, including Wells Fargo & Company (WFC).

At the same time, the company is targeting more organic growth at home as well as tapping attractive emerging markets. It has a presence in 22 countries each generating revenues of more than $1 billion. Moreover, the company’s focus on strategic investments and acquisition has strengthened GE’s market position.

GE is known for taking bold decisions to stay competitive and for focusing on core competency. For example, GE has recently exited its 100-year old “appliance and lighting” business, which is still subject to regulatory approval, as it neither fits GE’s core strength nor has a favorable competitive position.

In this series, we’ll take a comprehensive tour of GE’s segmental performance and fundamentals and wrap up with what analysts are recommending for the company’s stock. But let’s start with what has made—and continues to make—GE stand out among its industry peers.