Synchrony Financial

Latest Synchrony Financial News and Updates

General Electric’s Mission, Vision, and Strategy

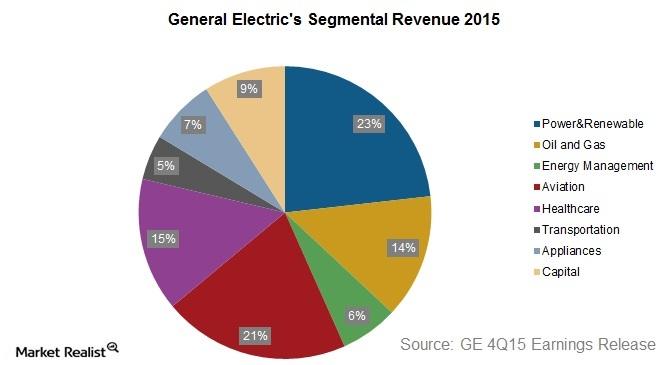

General Electric’s strategy is to reshape its portfolio from a broad conglomerate to a more focused industrial leader.

PayPal Continues to Invest in India Expansion

PayPal (PYPL) has continued to make more investments in India since it launched domestic operations in the country last year.

Why General Electric Is Focusing on Industrials?

Originally incorporated in 1892, General Electric is one of the largest and most diversified industrials and financial services corporations in the world.