Europe Dominates Global Green Bonds Issuance in 2017

Green muni bonds accounted for 56% of US green bond issuances in the first half of 2017 and are expected to touch $10 billion this year.

Nov. 7 2017, Published 9:01 a.m. ET

VanEck

Europe dominates

European issuers have dominated global issuance this year with nearly $38 billion of green bonds issued versus $22 billion in 2016. France accounts for 40% of this, and January’s landmark €7 billion French sovereign green bond deal has been complemented by a variety of offerings from blue-chip French corporate such as EDF, Engie, and SNCF.[1. Source: Climate Bonds Initiative] Reflective of the heavy European issuance and demand, euro-denominated bonds have been most common this year compared to last year which saw more U.S. dollar-denominated issuance.

U.S. issuers have brought approximately $11 billion green bonds to market this year, with about half from municipal issuers. Approximately $3.5 billion of securitized green bonds have come to market from issuers such as MidAmerican Energy, Fannie Mae, and others.[2. Source: Climate Bonds Initiative] U.S. corporate issuance, however, continues to lag. Apple (AAPL) issued its second green bond earlier this year, while companies like Kaiser Permanente and Brookfield Renewable Partners also brought green bonds to market.

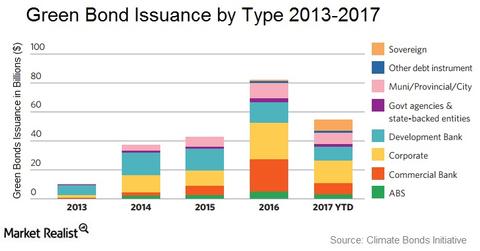

Overall, corporate issuance has comprised about 34% of global new issues this year, followed by development banks (17%) and commercial banks (17%).

Market Realist

Europe dominated this year’s green bond issuance

In 2017, Europe (VGK) (HEZU) accounted for 48% of the global green bonds market issuance. France (EWQ) started the year by issuing a $7.5 billion green bond. France’s public sector financial institution also issued a $527.4 million green bond.

Sweden issued its third green bond worth $500.0 million. Denmark’s debut into the green bond market was marked with its local government funding agency-issued bond worth $559.1 million.

Luxembourg’s independent nonprofit Finance Labelling Agency (or LuxFLAG) was endorsed by its Ministry of Finance for the launch of a new green bond label program. Norway contributed when its municipality-owned power company, Lyse AS, issued its inaugural five-year green bond worth $58.2 million.

Despite President Trump’s decision to withdraw from the Paris Agreement, US green bond issuances weren’t affected. State-level support continues with California and Texas issuing green bonds and lending their support to combatting climate-related risks.

Green muni bonds accounted for 56% of US green bond issuances in the first half of 2017 and are expected to touch $10 billion this year.

The chart above shows that corporate issuers, development banks, and commercial banks have been the most significant contributors to green bonds issuance since 2013.