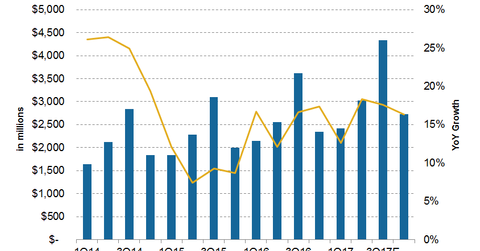

Assessing Priceline’s Revenue Growth in 2017

Analysts expect Priceline’s fiscal 2017 revenues to grow 16.7% YoY to $12.5 billion, which is slightly lower than the 16.5% YoY growth seen in 2016.

Nov. 3 2017, Updated 7:33 a.m. ET

Analyst estimates

Analysts expect Priceline’s (PCLN) 3Q17 revenues to grow 17.6% year-over-year (or YoY) to $4.3 billion, lower than the 18.3% YoY growth seen in 2Q17.

Analysts expect its fiscal 2017 revenues to grow 16.7% YoY to $12.5 billion, which is slightly lower than the 16.5% YoY growth seen in 2016.

Given Priceline’s expected slowdown in gross bookings, analysts currently expect revenue growth to decelerate. For 2018, analysts expect 15.4% YoY growth in revenues.

China: Difficult market with huge potential

Priceline’s (PCLN) significant growth to date has come from Europe through Bookings.com, which Priceline acquired in 2005 as a subsidiary. Priceline’s CEO, Glenn Fogel, expects the next leg of growth to come from the Asian market, particularly from China.

This optimism stems from the fact that the online booking penetration in these markets is extremely low and has the potential for huge growth. This trend is due to the increasing number of travelers resulting from the rising income levels in these countries.

Long-term growth

Online booking comprised ~40% of the entire travel market with a value of ~$650 billion in 2015. The online travel market’s double-digit growth is expected to continue as Internet penetration around the world increases. This trend could bode well for the online travel industry.

Investors can gain exposure to Priceline (PCLN) stock by investing in the PowerShares DWA Consumer Cyclicals Momentum Portfolio ETF (PEZ). Priceline holds the second-highest weight in PEZ of ~4.8%.

PEZ also holds 2.6% in Expedia (EXPE). However, this ETF has no exposure to online travel stocks TripAdvisor (TRIP) and Ctrip International (CTRP).