Under Armour Beats Earnings per Share Estimate by $0.03

Baltimore-based Under Armour (UAA) reported its 3Q17 results on October 31.

Nov. 3 2017, Updated 7:33 a.m. ET

Under Armour’s 3Q17 results

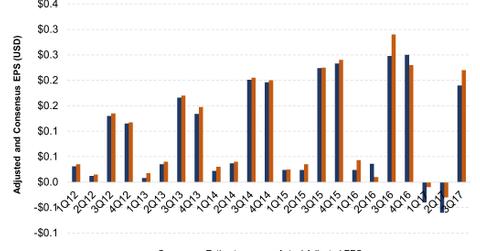

Baltimore-based Under Armour (UAA) reported its 3Q17 results on October 31. The company reported a 4.5% YoY (year-over-year) fall in revenue to $1.4 billion, missing analysts’ estimate by $80 million. Its bottom line, however, exceeded the expectation by $0.03, standing at $0.22.

Stock market and valuation update

Despite the earnings beat, Under Armour’s stock price fell a whopping 23.7%, touching a five-year low of $12.48 and closing at $12.52 on October 31. The stock tumbled another 3.5% the next trading day, due to the company’s fiscal 2017 guidance being far below analyst expectations.

Under Armour is currently trading at a one-year forward price-to-earnings ratio of 45.4x, versus a three-year average of 63x. However, it continues to trade at a premium to sportswear competitors Nike (NKE) (23x), Columbia Sportswear (COLM) (21.4x), and Lululemon Athletica (LULU) (24.7x).

Later in this series, we’ll discuss the company’s revised guidance, recent stock market performance, and valuation, and analysts’ views on the company. Investors seeking exposure to Under Armour could consider the PowerShares S&P 500 High Beta Portfolio ETF (SPHB), which invests 0.73% of its portfolio in the company.