Align Technology versus Peers in June 2017: Analyst Recommendations

For 1Q17, Align Technology (ALGN) reported revenues close to $310.3 million, which represents YoY (year-over-year) growth of around 30.0%.

June 12 2017, Published 3:41 p.m. ET

Align’s performance in 1Q17

For 1Q17, Align Technology (ALGN) reported revenues close to $310.3 million, which represents YoY (year-over-year) growth of around 30.0% and QoQ (quarter-over-quarter) growth close to 5.8%. The higher-than-estimated revenue, margin, and volume performance of the company was mainly attributed to a robust rise in Invisalign case shipments.

In 1Q17, Align Technology shipped ~208,000 Invisalign cases to nearly 39,000 doctors, which implies a 27% YoY rise in sales volumes.

Align Technology offers intraoral scanners, clear aligner technology, and CAD (computer-aided design), and CAM (computer-aided manufacturing) digital services to dentists around the world. In 1Q17, the company witnessed robust demand trends in North America as well as in international markets. The leading driver of this healthy operational performance was the company’s Invisalign Teen clear aligner system, which reported 32% YoY growth in sales volumes in 1Q17.

Notably, Align Technology accounts for about 1.3% of the iShares S&P Mid-Cap 400 Growth ETF’s (IJK) total portfolio holdings.

Analysts’ recommendations

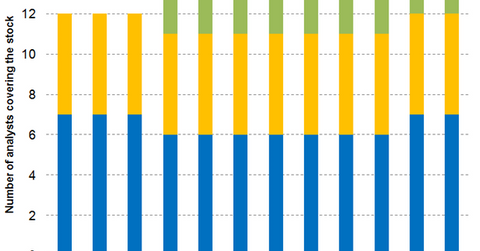

Of the 13 analysts covering Align Technology in June 2017, seven have rated the company as a “strong buy,” and five have rated it as a “buy.”

One analyst has rated Align Technology as a “hold,” while none of the analysts have rated it as a “sell or “strong sell.” Approximately 92% of analysts have given the company some form of “buy” recommendation.

Peer ratings

By comparison, of the 22 analysts covering Dentsply Sirona (XRAY) in June 2017, ~60% have rated the company as a “buy.” Approximately 84% of the 19 analysts covering Danaher (DHR) have given it “buy” recommendations, and 44% of the 18 analysts covering 3M Company (MMM) have rated the stock as a “buy.”

In the next part, we’ll discuss revenue growth prospects for Align Technology for 2017 in greater detail.