Here’s Why L Brands’ Dividend Yield Is Rising

Reasons behind L Brands’ growing yield Specialty fashion retailer L Brands (LB) saw its sales slow between 2013 and 2016. The company recorded revenue growth of 3.5% in 2016, compared with 6% in 2015. The growth was driven by the Victoria’s Secret and Bath & Body Works segments. Whereas its operating income grew 12% in 2015, it […]

Sept. 11 2017, Published 12:32 p.m. ET

Reasons behind L Brands’ growing yield

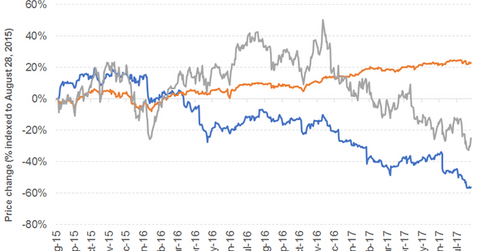

Specialty fashion retailer L Brands (LB) saw its sales slow between 2013 and 2016. The company recorded revenue growth of 3.5% in 2016, compared with 6% in 2015. The growth was driven by the Victoria’s Secret and Bath & Body Works segments. Whereas its operating income grew 12% in 2015, it fell 9% in 2016 due to revenue slowdown and an 4% increase in operating expenses.

L Brands’ earnings per share

The company’s interest expenses rose 3% and 18%, respectively, in 2015 and 2016. As a result, its EPS (earnings per share) rose 21% in 2015 and fell 6% in 2016. Its free cash flow also fell in 2016, due to higher capital expenditure.

L Brands had a debt-to-equity ratio of close to 8x in 2016. The stock’s returns have fallen since then, and the apparel industry has reported negative returns.

Growing dividend yield decoded

L Brands’ sales fell 6% in 1H17, followed by a 30% fall in operating income despite flat operating expenses. Its EPS fell 42%. The stock’s price slump inflated the company’s dividend yield figures.

The Global X SuperDividend ETF (SDIV) has a major stake in real estate. It is a geographically diversified fund with a major exposure to North America, and offers a dividend yield of 6.7%, at a PE (price-to-earnings) ratio of 11.6x. It has an exposure of 25% to small-cap stocks. The WisdomTree Emerging Markets Equity Income ETF (DEM) is diversified across geographies and sectors. It has substantial exposure to Asia and financials and offers a dividend yield of 3.5%, at a PE ratio of 10.6x. It has a 2% exposure to small caps.