National Oilwell Varco’s Valuation Compared to Its Peers

National Oilwell’s valuation, expressed as the TTM PE (price-to-earnings) multiple, isn’t available due to its negative adjusted earnings.

Sept. 13 2017, Updated 3:06 p.m. ET

Comparing companies

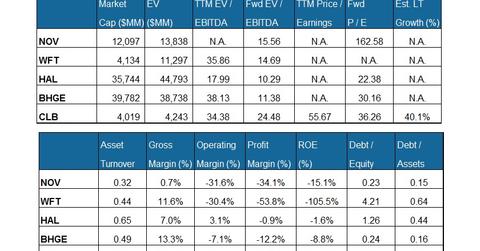

Baker Hughes, a GE company (BHGE), is the largest company by market capitalization among our set of select OFS (oilfield equipment and services) companies. As you can see in the following table, Core Laboratories (CLB) is the smallest company by market capitalization.

National Oilwell Varco’s EV-to-EBITDA multiple

National Oilwell Varco’s (NOV) EV (enterprise value), when scaled by the TTM (trailing 12-month) adjusted EBITDA (earnings before interest, tax, depreciation, and amortization), isn’t meaningful due to negative earnings. The adjusted EBITDA excludes extraordinary charges like asset write-offs, severance, and facility closure charges. National Oilwell Varco accounts for 0.74% of the iShares North American Natural Resources ETF (IGE). IGE fell 6% in the past year—compared to a 4% fall in National Oilwell Varco’ stock price during the same period.

The company’s forward EV-to-EBITDA multiple is positive. It’s in line with its peers’ average in our group. Baker Hughes’s forward EV-to-EBITDA multiple fell the most compared to the current EV-to-EBITDA multiple. The expected rise in Baker Hughes’s adjusted operating earnings in the next four quarters is more extreme compared to its peers, which usually reflects in high current EV-to-EBITDA multiple.

Debt levels

National Oilwell Varco’s debt-to-equity multiple (or leverage) is lower than the group average. A lower multiple indicates a lighter debt load compared to shareholders’ equity and decreased riskiness. Weatherford International’s (WFT) leverage is the highest in our group. For a comparative analysis of OFS companies’ free cash flows, read Oilfield Services Stocks: Free Cash Flow Winners and Losers.

PE ratio

National Oilwell’s valuation, expressed as the TTM PE (price-to-earnings) multiple, isn’t available due to its negative adjusted earnings. Its forward PE multiple is the highest in the group, while Halliburton’s (HAL) forward PE multiple is the lowest in the group.

In the next part, we’ll discuss whether investors have shown interest in National Oilwell Varco stock.