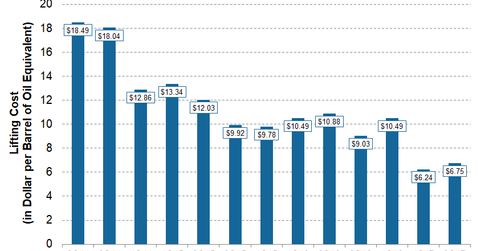

Marathon Oil’s Lifting Costs

In 2Q17, Marathon Oil’s (MRO) reported a lifting cost of ~$6.75 per boe (barrel of oil equivalent), which is ~28.0% lower than its 2Q16 lifting cost of ~$10.88.

Nov. 20 2020, Updated 4:01 p.m. ET

Marathon Oil’s lifting costs

In 2Q17, Marathon Oil (MRO) reported a lifting cost of ~$6.75 per boe (barrel of oil equivalent), which is ~28.0% lower than its 2Q16 lifting cost of ~$10.88. Sequentially, Marathon Oil’s lifting costs rose ~8.0% compared to its lifting cost of $6.24 in 1Q17.

Lifting costs (also called production costs) are the costs to operate and maintain wells after drilling is complete. Lifting cost is derived by adding lease operating expenses (or LOE), workover costs, and production taxes. In 2Q17, its LOE was $5.37 per boe (barrel of oil equivalent), which is ~18.0% higher than LOE in 2Q16 of ~$6.29 per boe.

Peers

MRO’s peers Stone Energy (SGY) and Diamondback Energy (FANG) reported LOEs of $8.88 per boe and $4.14 per boe, respectively, in 2Q17. FANG’s LOE is much lower than many other oil (USO) and gas producers in the United States, mainly because it operates in the low-cost Permian Basin. To know more about upstream companies operating in the Permian Basin, refer to Market Realist’s series Is the Permian Still the Hottest Basin in Oil and Gas?