Agilent Technologies’ Downward Sloping Dividend Yield Curve

Agilent Technologies’ net revenue rose 6.0% in the first nine months of 2017, driven by every segment. Income from operations rose 41.0% as total costs didn’t increase much.

Sept. 20 2017, Published 11:10 a.m. ET

Agilent Technologies’ revenue and earnings

In this part of the series, we’ll look at Agilent Technologies, a healthcare company that offers solutions to the global life sciences, diagnostics, and applied chemical markets. It reported a 4.0% rise in net revenue for 2016 after flat growth in 2015. It noted a growth in every segment in 2016; namely, life sciences and applied markets, diagnostics and genomics, and Agilent CrossLab. That was unlike 2015 when only Agilent CrossLab reported growth, offset by the rest. Income from operations saw an 18.0% rise in 2016 compared to 25.0% in 2015. In 2015, total costs and expenses decreased, unlike 2016 which saw an increase in SG&A (selling, general, and administrative) expenses. Diluted EPS (earnings per share) rose 17.0% in 2016 compared to a 26.0% fall in 2015. Interest expenses rose in 2016 after decreasing in 2015. EPS was supported by share buybacks as well.

Agilent Technologies’ net revenue rose 6.0% in the first nine months of 2017, driven by every segment. Income from operations rose 41.0% as total costs didn’t increase much. Diluted EPS rose 53.0% despite higher interest expenses. EPS has been supported by share buybacks as well. The company has maintained a reasonable free cash flow balance.

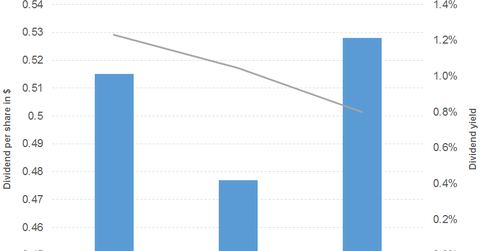

Agilent Technologies’ dividend trajectory

Agilent’s downward trending dividend yield curve was initially driven by the 2016 dividend cut. The downward slope was further supported by the sharp rise in prices, as depicted below.

Here are two dividend ETFs with exposure to Agilent Technologies. The WisdomTree LargeCap Dividend ETF (DLN) offers a 2.5% dividend yield at a PE (price-to-earnings) multiple of 20.1x. It has a 17.0% exposure to technology. The WisdomTree Total Dividend ETF (DTD) offers a dividend yield of 2.5% at a PE multiple of 20.5x. It has a 15.0% exposure to technology.