Green Bond Drivers: The Same as Conventional Bonds

Green bonds are used by organizations worldwide to fund environmentally sustainable projects such as renewable energy, energy efficiency, and clean water.

Sept. 18 2017, Published 9:25 a.m. ET

VanEck

Green bonds finance projects with a positive environmental impact, which gives them a specific focus beyond most non-green “conventional” bonds. But in terms of their yield and performance, green bonds are generally driven by the same factors that impact most conventional bonds.

Similar Return Drivers as Other Bonds

Conventional bond returns are driven primarily by changes in interest rates, the market’s perception of credit risk, and when investing globally, currency appreciation or depreciation. Supply and demand, liquidity, and other contractual terms of the obligation (e.g., callability) also have an impact. Green bonds are no different from conventional bonds in this regard. Drivers of risk and return are the same because green bonds are backed by the full balance sheet of the issuer in the vast majority of cases. Although green bond proceeds are used only to finance environmentally friendly projects, the payment of principal and interest is not contingent on the success or failure of these projects.1

As the drivers of risk and return for a green bond and a conventional bond from the same issuer are identical (all else being equal), one might expect yields to be in line. Anecdotally this is the case. Underwriters generally report that new green bonds are issued on the issuer’s yield curve (or perhaps slightly above to reflect a new issue discount, which is common for any new bond issue). On the other hand, despite the rapid growth in green bond issuance over the past few years, there is significant demand for new green bonds and new issues tend to be heavily oversubscribed. This has led to a perception that a green bond premium has developed, allowing issuers to pay lower yields on bonds carrying a green label versus conventional bonds.

1It is possible to issue a green project bond or securitized bond, however these are less common and again would behave the same way as a similar bond without a green label.

Market Realist

Rising appetite for green bonds

Green bonds are used by organizations worldwide to fund environmentally sustainable projects such as renewable energy (TAN), energy efficiency, and clean water (PHO). Since the first corporate green bond was issued in 2013, companies such as Apple (AAPL) and Toyota (TM), government organizations such as New York’s Metropolitan Transportation Authority, and the governments of France and Poland have issued green bonds.

According to HSBC Global Research, yields on green bonds tend to be low, while returns are normally the same as those of conventional bonds. HSBC cited that the valuation of green bonds differs from comparable conventional bonds because cash flows from green bonds are reinvested in green projects that usually have government backing. Some green bonds may provide certain tax advantages.

Rising demand

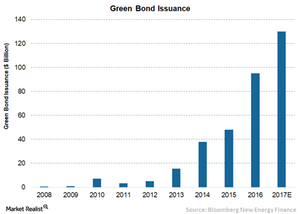

Although green bonds (GRNB) constitute a small portion[1. 0.60% of global bond sales in 2016] of the trillion-dollar debt market, their issuance has rapidly grown over the last few years. According to Bloomberg New Energy Finance, the issuance of green bonds rose from $500.0 million in 2008 to an estimated $130.0 billion in 2017, which would be a 37.0% rise over 2016. The increased awareness has led to many prominent funds signing on to the Principles for Responsible Investment when making their investment decisions. That has pushed up the demand for green bonds, with most of the issues being oversubscribed.