Will Genuine Parts Sustain Its Dividend Yield?

Genuine Parts (GPC) recorded a marginal growth in its 2016 net sales, driven by its Automotive and Office Products segments.

Aug. 16 2017, Published 9:44 a.m. ET

Genuine Parts: Services sector, specialty retail, other industry

Genuine Parts (GPC) recorded a marginal growth in its 2016 net sales, driven by its Automotive and Office Products segments. The company’s other segments include Industrial and Electrical/Electronic Materials. Its operating income fell due to higher operating expenses. All of these factors followed by a growth in its non-operating income led to a fall in EPS (earnings per share). It always generates enough free cash flow to honor its dividend commitments. Its financial leverage has seen an increasing trend, and its debt-to-equity ratio has been fairly low.

The company expects growth for every segment in 2017, driven by positive automotive market fundamentals, recovery in the energy and manufacturing segments, and diversification strategies of its Office Products Group.

We can see in the graph below that the company’s dividend yield has risen over the years, remaining above the 2.5% mark. (Note that the asterisk in the graph denotes an approximation in calculating the dividend.)

Net sales

Net sales for the first half of 2017 rose 5.0%, driven by every segment. Operating income fell due to higher operating expense. EPS rose due to lower income tax.

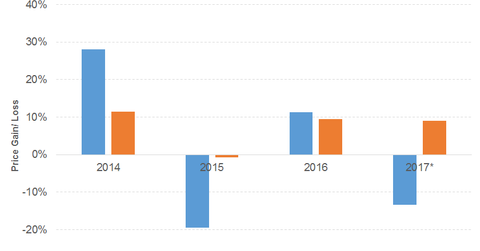

Prices have started falling after gains in 2016, as you can see in the above graph. (Note that the asterisk in the graph denotes the price gain or loss to date.) President Donald Trump’s infrastructure and tax policies and the country’s fundamentals will play a significant role in reviving demand for this industry. Genuine Parts has been beaten by the S&P 500, although it looks better positioned than its rival AutoZone (AZO).

GPC stock has fallen 13.4% on a YTD (year-to-date) basis.

Genuine Parts’ PE (price-to-earnings) ratio of 18.0x compares to a sector average of 20.5x. Its dividend yield of 3.3% is the sector average.