Behind the Break-Even Price Trends for the Permian and Top US Shale Plays

The Midland and Delaware Basins, which are sub-basins of the Permian Basin, had the lowest break-even prices.

Aug. 18 2017, Published 12:26 p.m. ET

Break-even prices

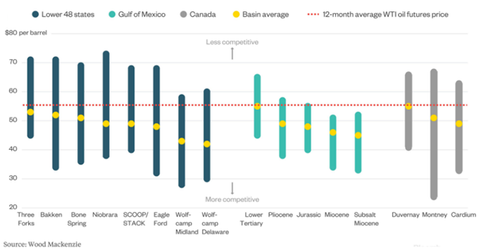

Analysts at Wood Mackenzie recently surveyed break-even oil prices across major North American plays, as well as the Gulf of Mexico.

As the image shows, the Midland and Delaware Basins, which are sub-basins of the Permian Basin, had the lowest break-even prices.

The Bakken and top players

By comparison, the Bakken had break-even prices of over $50. This suggests that, given its low break-even and low IRRs (internal rates of return), the Permian Basin might not yet have lost its charm. (For more insight, read Market Realist’s series The Dirt on the Permian Basin: Hot or Not?)

Notably, the top Permian players include Apache (APA), Concho Resources (CXO), and Pioneer Resources (PXD). Integrated companies with Permian exposure include Chevron (CVX) and ExxonMobil (XOM).

In the next part of this series, we’ll take a closer look at recent Permian Basin rig activity.