How to Take Exposure to Moat Stocks

The VanEck Vectors Morningstar Wide Moat ETF (MOAT) tracks the price and yield performance of the Morningstar Wide Moat Focus Index.

July 17 2017, Updated 1:06 p.m. ET

VanEck

VanEck Vectors® Morningstar Wide Moat ETF (MOAT®) and VanEck Vectors® Morningstar International Moat ETF (MOTI®) provide access to global moat-rated companies, by seeking to replicate the Morningstar® Wide Moat Focus IndexSM and Morningstar® Global ex-US Moat Focus IndexSM, respectively. Each Index tracks the overall performance of attractively priced companies with sustainable competitive advantages in their respective markets according to Morningstar’s equity research team.

Market Realist

VanEck Vectors Morningstar Wide Moat ETF

The VanEck Vectors Morningstar Wide Moat ETF (MOAT) tracks the price and yield performance of the Morningstar Wide Moat Focus Index.

The index is made up of US-based, wide-moat stocks that are trading at discounts to their intrinsic values as determined by Morningstar.

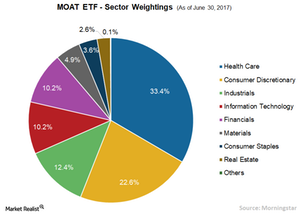

On June 30, 2017, MOAT comprised 50 stocks, with the healthcare sector making up the largest chunk of its portfolio at 33.4%, followed by the consumer discretionary sector at 22.6%, the industrials sector at 12.4%, and the information technology and financials sectors at 10.2% each. Some of MOAT’s top holdings include Guidewire Software (GWRE), Polaris Industries (PII), VF Corporation (VFC), and Gilead Sciences (GILD).

VanEck Vectors Morningstar International Moat ETF

The VanEck Vectors Morningstar International Moat ETF (MOTI) tracks the price and yield performance of the Morningstar Global ex-US Moat Focus Index.

The index is made up of attractively priced ex-US companies with sustainable competitive advantages as determined by Morningstar.

On June 30, 2017, MOTI held a total of 77 stocks in its portfolio from China (17.8%), Australia (14.4%), Singapore (11.2%), Japan (8.2%), and Germany (7.3%).

The financial sector accounted for the largest chunk of MOTI’s portfolio at 20.3%, followed by the healthcare sector at 15.3%, the telecommunications sector at 12.2%, and the industrials and consumer discretionary sectors at 11.1% each.

Some of the top companies in MOTI include Kion Group at 2.1%, Oversea-Chinese Banking Corporation at 2.1%, Cheung Kong Property Holdings at 2.1%, and CapitaLand Commercial Trust at 2.1%.