How to Identify Economic Moats

In this series, we’ll discuss how intangible assets can create long-term competitive advantages for companies.

July 17 2017, Published 11:26 a.m. ET

VanEck

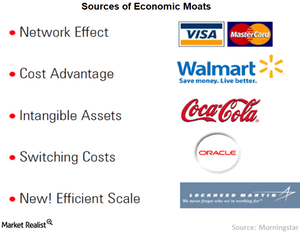

“How Moats Translate into Sustainable Competitive Advantages” is a five-part moat investing education series that explores the primary sources of economic moats. The idea of an economic moat refers to how likely a company is to keep competitors at bay for an extended period. According to Morningstar Equity Research, there are five key attributes that can give companies economic moats, and which are viewed as sources of sustainable competitive advantages: 1) Network Effect; 2) Intangible Assets; 3) Cost Advantage; 4) Switching Costs; and 5) Efficient Scale. Here we explore the concept of “Intangible Assets.”

Market Realist

Sustainable competitive advantage

The concept of moat investing refers to a company’s ability to stay ahead of the competition by maintaining a sustainable growth rate and protecting its market share from competitors. In other words, moat companies (CVS) (LB) have competitive advantages that help them create long-term value for all stakeholders involved.

For a company, a competitive advantage could be something like access to cutting-edge technology, the availability of quality raw materials at a cheaper rate, or a brand or product/service differentiation.

Higher returns on capital

Looking at the company’s historical performance is important if we want to identify whether it has an economic moat (DIS) (PFE) or not. According to Morningstar, if a company has consistently generated returns on capital in excess of its capital costs and its return on capital is rising at a steady rate, it’s safe to assume that it has developed an economic moat (MOAT).

The competitive advantage created by the company should be sustainable over an extended period of time. Otherwise, it won’t be too long until a competitor enters the market with a better product.

In this series, we’ll discuss how intangible assets can create long-term competitive advantages for companies.