Why Cliffs Natural Resources’ Stock Fell despite an Earnings Beat

Cliffs Natural Resources (CLF) released its 2Q17 results on July 27, 2017, before the market opened. Here’s what you need to know.

July 28 2017, Published 4:12 p.m. ET

CLF’s 2Q17 earnings beat

Cliffs Natural Resources (CLF) released its 2Q17 results on July 27, 2017, before the market opened. A conference call with securities analysts and institutional investors took place on the same day to discuss the results.

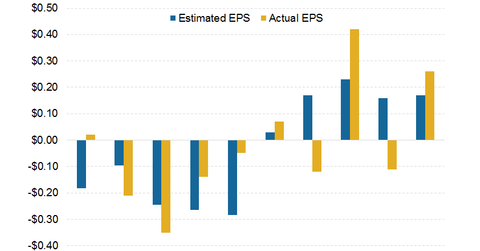

Cliffs Natural Resources’ 2Q17 results solidly beat analysts’ estimates. The company reported earnings per share (or EPS) of $0.26, beating the consensus estimate of $0.17 as per the consensus compiled by Thomson Reuters. Its revenues of $569 million also beat market expectations of $486 million by 17%.

Stock price plunged despite the beat

Cliffs Natural Resources’ (CLF) stock price traded 10% lower intraday on July 27 but settled 5% lower at $7.34. While the company’s earnings beat analyst estimates, it again cut its guidance for EBITDA (earnings before interest, tax, depreciation, and amortization) and net income in 2Q17 after downgrading them in 1Q17. The new cut reflected year-to-date US steel prices and iron ore prices as well as higher SG&A (selling, general, and administrative) costs.

Cliffs’ stock price reaction contrasts with Cliffs’ US peers’ (SLX) performance after reporting solid 2Q17 results. AK Steel (AKS) reported better-than-expected earnings on July 25, 2017, and gained 12% on the day of results. U.S. Steel (X) also reported an earnings beat. Previously, both Nucor (NUE) and Steel Dynamics (STLD) missed consensus expectations.

Series overview

Investors can use this series to gauge CLF’s fundamentals. In this series, we’ll discuss its 2Q17 results, conference call highlights, management guidance, and outlook. We’ll also see how it’s planning to progress on new growth initiatives.

We’ll start by looking at the project’s economics, construction timeline, and financing in the next part of this series.