Under Armour Trading 40% Lower Than a Year Ago

Under Armour (UAA) stock remained unfazed after the company announced its new senior level executives, rising ~1.0% and closing at $25.06.

June 28 2017, Updated 11:35 a.m. ET

Under Armour and the stock market

Under Armour (UAA) stock remained unfazed after the company announced its new senior level executives, rising ~1.0% and closing at $25.06.

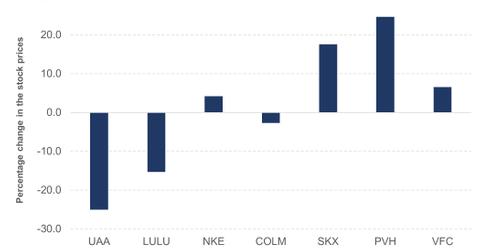

The athletic wear manufacturer has fallen about 25.0% YTD (year-to-date) and is trading 40.0% lower than its year-ago price. It’s also trading 105.0% below its 52-week high.

The company’s performance is the worst among sportswear manufacturers this year. In comparison, Nike (NKE) has risen ~4.0% YTD, Lululemon Athletica (LULU) has fallen 15.0%, and Columbia Sportswear (COLM) has fallen 3.0%.

The company’s poor stock market performance is a result of its declining popularity, slowing growth, and deteriorating margins.

What to expect from UAA stock

Under Armour is no more a Wall Street darling. In fact, analysts are mostly bearish on the stock and have predicted its price to fall another 2.0% over the next 12 months. The 34 analysts covering UAA have set a price target of $21.42. Individual target prices range between $14 and $40.

Nike, Lululemon, and Columbia Sportswear have upsides of 14.0%, 10.0%, and 12.0%, respectively.

Earnings potential and valuations

When we look at valuations, Under Armour is still the most expensive sportswear company. It currently trades at 51.0x compared to 22.0x for NKE, 23.0x for LULU, and 20.0x for COLM.

However, it has the weakest earnings potential. Its EPS (earnings per share) is expected to fall 27.0% over the next 12 months compared a rise of 8.8% for LULU and a 2.0% rise for COLM. Nike’s EPS is predicted to fall marginally by ~0.40% over the next year.

If you want to add exposure to Under Armour, you can consider the PowerShares S&P 500 High Beta ETF (SPHB), which invests ~1.0% of its portfolio in the company.