Prospect Capital’s Total Investments Increase in 2017

In fiscal 3Q17, Prospect Capital’s total value of investments stood at $6.0 billion in 125 companies, compared to $5.9 billion in fiscal 2Q17 in 123 companies.

June 1 2017, Updated 7:37 a.m. ET

Increase in portfolio investments

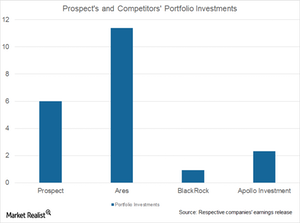

Prospect Capital (PSEC) reported increasing numbers in its total portfolio investments in fiscal 3Q17 compared to fiscal 2Q17. In fiscal 3Q17, Prospect Capital’s total value of investments stood at $6.0 billion in 125 companies, compared to $5.9 billion in fiscal 2Q17 in 123 companies.

Prospect Capital is facing tough competition from Ares Capital Corporation (ARCC). In 1Q17, Ares Capital reported increasing numbers of its total portfolio investments, which stood at $11.4 billion compared to $8.8 billion in 4Q16. As a result, ARCC increased the number of its portfolio companies from 218 in 4Q16 to 316 in 1Q17. PSEC’s other competitors reported the following numbers on March 31, 2017:

Ares Capital’s SDLP

SDLP, or Senior Direct Lending Program, represents a joint venture between Varagon Capital Partners and Ares Capital Corporation (ARCC). Billions of dollars have been funded by ARCC in SDLP. However, there are only 14 borrowers in SDLP and only 16 financial sponsors. Of these 14 borrowers, five of them account for $270 million.

Currently, SDLP hasn’t exceeded $300 million. In 4Q16, SLDP completed two investments—Triwater Holdings/Edgewater Capital & JZ Partners, as well as Arrowhead Electrical Products.

SDLP has been beneficial for Ares Capital, as SDLP has provided robust excellent performance during the past few months. SDLP has been extending high-quality first lien loans at market yields under 7%. Ares Capital has been attaining 14% return on capital.

On December 31, 2016, the value of Ares Capital’s investment assets totaled $6.7 billion. Ares’s future has been largely dependent on SDLP. After its GE Capital loans are repaid, ~30% of Ares Capital’s assets at risk would be accounted for by SDLP assets.

Together, Apollo Investment (AINV), BlackRock Capital Investment Corporation (BKCC), and Ares Capital Corporation (ARCC) comprise ~26.5% of the VanEck Vectors BDC Income ETF (BIZD).