What’s Holding Back Foreign Investors from China?

Many leading bond index providers are still not including China’s onshore bonds in their benchmark indexes due to various regulatory and operational concerns.

May 31 2017, Updated 7:37 a.m. ET

VanEck

What is Preventing China’s Inclusion Today?

Certain issues have prevented China’s inclusion in global bond indexes. Despite progress in opening up markets, the operational hurdles to do so remain onerous. Investors must have a local onshore custodian, and the registration process has proven to be somewhat lengthy and burdensome. There is still a need for greater access to onshore hedging tools, and certain tax rules remain undefined for foreign investors.

Most importantly, investors and index providers want some assurance that there will not be any backtracking of the progress made over the past two years. There must be some proof of concept that there would be no restrictions on repatriation of foreign currency when funds sell onshore bonds (i.e., fear of capital controls), particularly in a stressed market environment.

Market Realist

Despite reforms, foreign investors have many concerns

Notwithstanding recent reforms, many leading bond index providers are still not including China’s onshore bonds in their benchmark indexes due to various regulatory and operational concerns. The JPMorgan GBI-EM (Government Bond Index-Emerging Markets index) (EMLC) (EMAG) (IGEM) (PCY), a leading benchmark for emerging market bonds, still does not include China in the index due to various operational and technical concerns that need to be clarified before it decides to include it.

Similarly, although Citigroup has included China’s domestic bonds in three subindexes, it still hasn’t decided about including China in its dominant WGBI (World Government Bond Index) (BWX) (IGOV). The WGBI had a market value of $20.3 trillion at the end of April. On the other hand, Bloomberg Barclays intends to keep its original benchmark index intact, while planning to create new variants of the index to include Chinese bonds. Consequently, the Bloomberg Barclays Index will give investors the option to include Chinese bonds in their portfolios or not.

Investors’ concerns

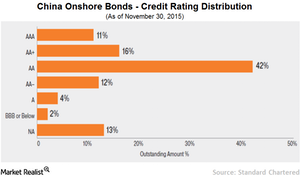

Foreign investors are still not entirely convinced about opening up China’s onshore bond (EMLC) market. Concerns raised by investors include those related to the broader macro environment, future policy direction, rising credit risk, and the difficulty comparing credit ratings. There is a significant difference between credit ratings provided by Chinese agencies and those of international agencies. More than 70.0% of issuers are rated AA or higher by Chinese agencies, while less than 1.0% are rated BBB or lower, which in many cases could be questionable.