Bond Market Reform Is a Priority for Policymakers

In the third and final phase of bond (EMB) reforms that began after 2015, the substantial activities of the market were open to global investors.

May 30 2017, Updated 3:05 p.m. ET

VanEck

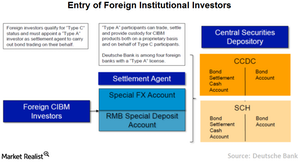

Significant progress was made to open up the interbank market in 2016 with the introduction of a registration process that allowed certain types of foreign institutional investors to access the market directly, provided they have established proper custodial and clearing accounts. Importantly, this scheme did away with the quotas, lock up periods, and repatriation limits of QFII/RQFII frameworks. In 2017, foreign investors were given the ability to hedge currency risks in onshore derivative markets, and officials recently approved the creation of a “Bond Connect” scheme that will allow foreign investors to purchase onshore bonds through a trading link with Hong Kong.

Opening up China’s bond market to foreign investors is a priority for policymakers, and supports ongoing efforts to internationalize the Chinese yuan (CNY) and provide a much needed alternative to domestic financing. In addition, the expected inflows from long-term foreign investors could help to ease domestic outflow pressures currently experienced.

Market Realist

Reforms initiated to internationalize the financial markets

In the third and final phase of bond (EMLC) (EMAG) (IGEM) reforms that began after 2015, the substantial activities of the market were open to global investors. In July 2015, the PBoC (People’s Bank of China) allowed foreign central banks, sovereign wealth funds, and global financial organizations to invest in the onshore market, while doing away with the earlier requirement of prior approval and investment quotas. In February 2016, the onshore market was wide open to all types of foreign investors, including commercial banks, insurance companies, securities companies, asset management companies, charity funds, donation funds, pension funds, and other publicly and privately held medium-term and long-term investors. However, by clearly specifying “mid-term” and “long-term” investors, the PBoC retained the authority to restrict short-term or speculative investments in the bond market (PCY) (VWOB).

Allowed currency risk hedging

Further reforms were initiated in late 2016 when China allowed foreign investors buying onshore bonds (LEMB) (ELD) to hedge the foreign exchange risk by using hedging tools such as FX (foreign exchange) forwards and swaps and currency swaps. Because of the foreign exchange reforms, foreign holdings in China rose five times, or by $30.0 billion, in 2016 over 2015, according to data from the Oppenheimer funds. The reforms initiated by Chinese authorities are part of the effort to globalize their financial markets and widen the investor base operating in China’s huge onshore bond market.