What Are Dow Chemical’s Valuations ahead of 1Q17 Earnings?

As of April 19, 2017, Dow Chemical (DOW) traded at a one-year forward PE ratio of 14.60x.

April 21 2017, Updated 9:06 a.m. ET

Forward PE ratio

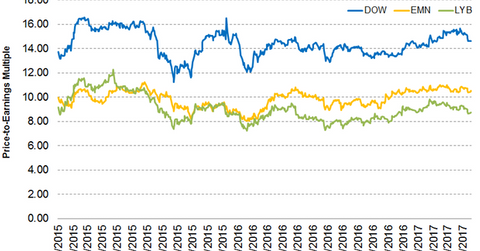

The forward PE (price-to-earnings) ratio is a relative valuation method that considers the company’s future earnings. As of April 19, 2017, Dow Chemical (DOW) traded at a one-year forward PE ratio of 14.60x compared to its peers Eastman Chemical (EMN) and LyondellBasell (LYB), which traded at one-year forward PE ratios of 10.40x and 8.7x, respectively.

The forward PE ratio tells how much investors are paying for the stock per dollar of expected earnings in the next 12 months. It’s one of the most popular valuation tools that helps investors compare two or more companies that operate in the same industry. It tells investors which stocks are overvalued and undervalued.

Dow Chemical trades at a premium

Currently, Dow Chemical is trading at a premium compared to its peers Eastman and LyondellBasell. Dow Chemical posted better-than-expected 4Q16 earnings due to the continued integration of Corning’s (GLW) business. After a two-year decline in revenue, analysts expect DOW’s 2017 revenue to increase to $51.9 billion. On the other hand, EMN and LYB have been struggling to grow their revenue.

Synergies from the Corning integration are expected to be more visible in 2017, which could lead to better earnings. Plus, the company received conditional approval from the European Commission for the Dow Chemical and DuPont merger, which is expected to bring approximately $3 billion in synergies. Analysts expect Dow Chemical to post EPS of $4.10 in 2017 and $4.36 in 2018. With earnings per share growing year-over-year, it appears that investors are willing to pay a premium compared to DOW’s peers.

Investors can hold Dow Chemical indirectly by investing in the Vanguard Materials ETF (VAW). VAW invests 8.5% of its portfolio in Dow Chemical as of April 19, 2017.