Underneath Under Armour’s Compressed Margins

Under Armour’s (UAA) gross margin fell 160 basis points to 46.5% in fiscal 2016, and its gross margin took the worst hit in the fourth quarter of 2016.

April 20 2017, Updated 10:37 a.m. ET

Evaluating Under Armour’s margins and profitability

Under Armour’s (UAA) gross margin fell 160 basis points to 46.5% in fiscal 2016. Its gross margin took the worst hit in the fourth quarter, falling a whopping 300 basis points to 44.8% in 4Q16—primarily on account of aggressive inventory management, negative currency effects, and a higher mix of footwear and international businesses.

UAA’s operating margin plunged 240 basis points to 12.7% in 4Q16 as SG&A (selling, general, and administrative) expenses surged 6%, resulting from the company’s ongoing investments in footwear, international, and DTC segments.

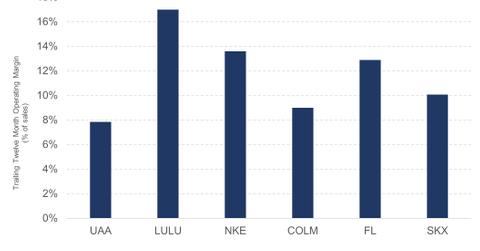

Notably, Under Armour has the lowest operating margin in the sportswear peer group. It has a trailing-12-month operating margin of 7.8%, as compared to Nike’s (NKE), Lululemon Athletica’s (LULU), and Columbia Sportswear’s (COLM) 13.6%, 17%, and 9%, respectively.

EPS under pressure in 2016

Notably, Under Armour has missed its bottom line estimates in two of the past four quarters. The company’s 4Q16 adjusted earnings per diluted share stood at 23 cents—$0.02 lower than the analyst expectations. Its EPS fell 4% YoY (year-over-year), driven by lower revenues, a lower gross margin, and a higher SG&A rate. UAA’s management and Wall Street are predicting a net loss for 1Q17.

ETF investors seeking to add exposure to UAA can consider the PowerShares S&P 500 High Beta Portfolio (SPHB), which invests 0.85% of its portfolio in the company.

Continue to the next part for a discussion of UAA’s profitability outlook for fiscal 2017.