How MLP Funds’ Capital Inflow Improved in 1Q17

MLP funds’ capital inflow has recovered slightly in recent quarters compared to the second half of 2015.

April 7 2017, Updated 8:08 a.m. ET

MLP funds’ capital inflow

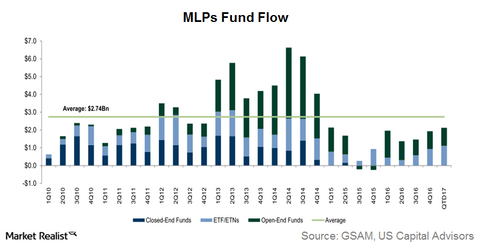

MLP funds’ capital inflow has recovered slightly in recent quarters compared to the second half of 2015. However, overall capital inflow is still lower than the seven-year average of $2.7 billion.

Two of the most well known MLP ETFs and ETNs are the Alerian MLP ETF (AMLP) and the JPMorgan Alerian MLP ETN (AMJ). Enterprise Products Partners (EPD) and Energy Transfer Partners (ETP) are the top holdings of AMLP and AMJ.

In the next part of this series, we’ll look at MLP funds’ performances in the recent quarter.