How Could Equity Markets React to the Fed’s Optimism?

On June 15, the day after the FOMC statement, most global markets traded with a negative tone.

June 16 2017, Updated 9:08 a.m. ET

US markets remained largely unchanged

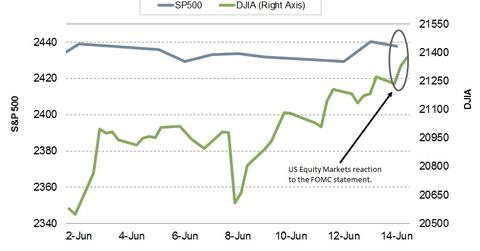

The US equity market’s reaction to the Fed’s statement was fairly muted. The surprisingly hawkish statement from the Fed after its June 14 meeting was met with a subdued response by market participants.

The statement outlined that the near-term risks to the economic outlook remained balanced, but the committee is closely monitoring inflation developments. In the US, the Dow 30 (UDOW) managed to close on a positive note at 21,374, posting a gain of 0.22% for the day, while the S&P 500 (SPY) and the NASDAQ (QQQ) closed lower by 0.10% and 0.41%, respectively.

Global market reaction

On June 15, the day after the FOMC statement, most global markets traded with a negative tone. A hawkish Fed statement that indicated global weakness in the markets could have resulted from some measures of removing liquidity from the markets, rising interest rates in the US (although this has been expected by markets), and softer US economic data.

Also, news about President Trump being investigated by special counsel Robert Mueller for possible obstruction of justice added to the global market’s weakness. At the time of this report, Asian markets (AAXJ) were trading at a 0.5% loss, and European markets (VGK) were down 1.0%.

Mixed message received by markets

The markets are questioning the Fed’s outlook for the US economy. Recent economic data from the US doesn’t paint the same picture about the US economy as the Fed’s report, in which the Fed termed this weakness as transitory.

We believe that investors could observe the country’s economic performance as aligning their views with that of the Fed. Until then, there could be a tug of war between bulls and bears, and the market could remain close to its recent levels.