Inside the Latest Geopolitical Risks: North Korea, Syria, and More

Markets these days are concerned about geopolitical risks more than ever, given the rapid growth in globalization and the interconnections between global markets.

April 19 2017, Updated 7:37 a.m. ET

The great unknown?

Markets these days are concerned about geopolitical risks more than ever, given the rapid growth in globalization and the interconnections between global markets. To be sure, most geopolitical events can have an immediate impact on an individual’s or a fund’s portfolio (AOR) (MDIV) holdings, and so it’s very important to understand these risks.

The US attack on Syria

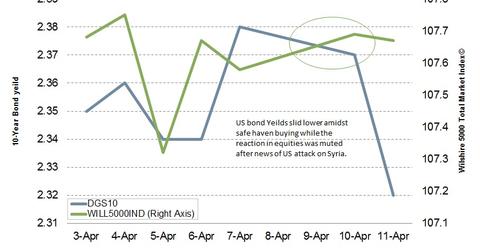

Market anxiety flared up suddenly after the Trump administration, without seeking the approval of the US Congress, launched 59 Tomahawk missiles on a Syrian airbase, presumably in retaliation to a chemical attack that has been blamed on Syrian forces. This attack has not yet escalated into a serious confrontation but has still managed to spook markets. The event could still escalate geopolitical tensions between the US, Syria, and Russia.

To be sure, market risk appetites waned after the event, and safe havens rallied after the news of the attack.

The North Korean nuclear nightmare

North Korea has been in the news for years for spooking the international community with its nuclear missile tests, and there have been reports about a possible sixth nuclear test, on the 105th birthday anniversary of North Korea’s founder, Kim Il Sung.

North Korean aggression will always be on top of the list for possible geopolitical risk events and markets, and Asian companies (BABA) located in the region are particularly likely to feel the impact of such an ongoing active uncertainty.

Should we be worried?

While we can’t predict geopolitical risk events, markets often have the ability to absorb surprises. Unless we see tensions escalating toward continued conflicts, sound fundamentals-based companies like Apple (AAPL), in the tech sector, and Gilead Sciences (GILD), in the pharmaceutical sector, will likely continue to drive markets in the long run. More than anything, what’s most important when it comes to geopolitical risks is the awareness that they exist.

We’ll discuss related concerns surrounding Donald Trump’s administration in the next part.