Should Investors Be Concerned about Intel’s Leverage?

Intel has long-term debt of $24 billion against cash reserves of $17 billion, resulting in net debt of $7 billion.

July 17 2017, Updated 10:40 a.m. ET

Cash flow

Intel’s (INTC) revenue growth has slowed, but its profit margins have increased as the company improved its operational efficiency through restructuring. However, its operating cash flow fell 3.9% YoY (year-over-year) to $3.9 billion in 1Q17 as its accounts receivable and inventory increased.

Intel spent ~$2.1 billion on capital expenditures and $2.4 billion on shareholder returns. It spent $1.2 billion on share buybacks and $1.2 billion on dividend payments.

Intel’s operating cash flow could fall further in 2Q17 as lower revenues reduce its profit in dollar terms.

Capex

Intel allotted $12 billion in capital expenditures for fiscal 2017 compared to its general $9 billion–$10 billion budget. This high capital budget is a result of the company’s investment in the China (FXI) memory plant. The company expects to allocate a similar amount of capital budget in fiscal 2018 until the China plant is completed.

However, Intel plans to reduce the budget in the long term unless it finds a differentiated technology like 3D XPoint to invest in.

Cash and debt position

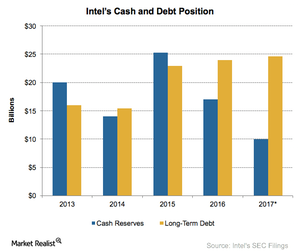

Intel has increased its shareholder returns while increasing its investments in the business by issuing debt. This has increased the company’s debt from $16 billion in fiscal 2013 to $24 billion in fiscal 2016.

The company’s debt increased $7.5 billion in fiscal 2015 when Intel acquired Altera. The company is preparing to acquire Israel-based Mobileye (MBLY) for $15.3 billion in fiscal 2017, which would increase its debt further.

Is Intel’s leverage ratio a cause of concern?

Looking at the debt figure in isolation does not determine whether a company’s leverage is at a dangerous level. Hence, debt is compared to the company’s cash reserves, and its interest burden is compared to operating income.

Intel has long-term debt of $24 billion against cash reserves of $17 billion, resulting in net debt of $7 billion. This shows that the company has less financial flexibility to make long-term investments. On the other hand, NVIDIA (NVDA) has a net cash position of $4 billion.

Intel’s interest expense increased from only $90 million in fiscal 2012 to $733 million in fiscal 2016 as its average interest rate and the amount of debt increased. However, the $733 million expense equates to only 6% of its operating income, which indicates that the company has strong capability to service the existing debt. It can also afford to pay three times more interest without stressing its earnings.

In Advanced Micro Devices’ (AMD) case, its interest expenses were so high that its operating income was not sufficient to meet the interest burden, resulting in a net loss.

Next, we’ll see what analysts think about Intel.