How Volatile Are the Top Oilfield Services Companies?

In this part of the series, we’ll compare the implied volatilities of the top OFS companies as rated by Wall Street analysts for 1Q17.

March 27 2017, Updated 9:06 a.m. ET

Halliburton’s implied volatility

In this part of the series, we’ll compare the implied volatilities of the top OFS (oilfield services and equipment) companies as rated by Wall Street analysts for 1Q17. In the previous parts of this series, we separated the best and the worst OFS companies by expected earnings growth.

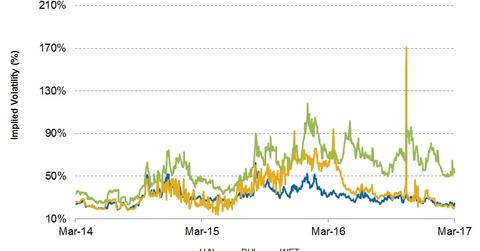

On March 22, 2017, Halliburton’s (HAL) implied volatility was ~24.5%. Since HAL announced its 4Q16 financial results on January 23, 2017, its implied volatility has remained nearly unchanged.

Implied volatilities for BHI and WFT

On March 22, 2017, Baker Hughes’s (BHI) implied volatility was ~21.0%. Since BHI announced its 4Q16 financial results on January 26, 2017, its implied volatility has fallen ~23.0% to its current level.

On November 1, 2016, BHI’s implied volatility rose after the company announced its partnership with General Electric (GE). You can find out more about the deal in Market Realist’s GE to Partner with BHI? The Changing Oilfield Services Landscape. BHI makes up 0.15% of the iShares Core US Value (IUSV). The energy sector makes up ~10.9% of IUSV.

On March 22, 2017, Weatherford International’s (WFT) implied volatility was ~52.0%. Since it announced its 4Q16 earnings on February 1, 2017, its implied volatility has fallen from ~73.0% to ~52.0%. You can read more on Weatherford International in Market Realist’s Will Weatherford’s Debt Repayment Plan Include Asset Sales?

What does implied volatility mean?

Implied volatility (or IV) reflects how investors view a stock’s potential movement. However, IV doesn’t forecast direction. IV is derived from an option pricing model. It’s worth noting that a suggested IV can be incorrect.

Energy stocks are typically correlated with crude oil prices. In the next part, we’ll see how the top OFS companies are correlated with crude oil.