What Do Analysts Recommend for Halliburton?

On March 24, 92% of the analysts tracking Halliburton rated it as a “buy,” ~5% rated it as a “hold,” and 3% rated it as a “sell.”

Nov. 20 2020, Updated 12:41 p.m. ET

Wall Street’s recommendations for Halliburton

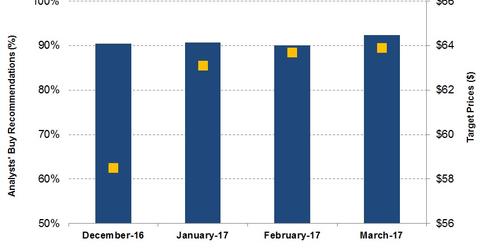

In this part, we’ll look at changes in Wall Street analysts’ recommendations for Halliburton (HAL) on March 24, 2017.

Consensus rating for Halliburton

On March 24, 92% of the analysts tracking Halliburton rated it as a “buy” or some equivalent. Approximately 5% of the analysts tracking Halliburton rated it as a “hold,” while 3% rated it as a “sell” or some equivalent. To learn more about Halliburton’s valuation, read Halliburton Outperformed Market: What Analysts Are Saying Now. In comparison, ~58% of the analysts tracking Baker Hughes (BHI) rated it as a “buy” or some equivalent.

Analysts’ rating changes

From December 24, 2016, to March 24, 2017, the percentage of analysts recommending a “buy” or some equivalent for Halliburton increased from 90% to 92%. Analysts’ “sell” recommendations fell during the same period. A year ago, ~78% of the sell-side analysts recommended a “buy” for Halliburton. Halliburton accounts for 2.6% of the iShares North American Natural Resources ETF (IGE).

Analysts’ target prices

On March 24, Wall Street analysts’ mean target price for Halliburton was $63.9. Currently, Halliburton is trading at ~$49.4. It implies ~29% upside at its current median price. A month ago, analysts’ average target price for Halliburton was $63.70.

The mean target price, surveyed among the sell-side analysts, for Oil States International (OIS) was $39.9 on March 24. Currently, Oil States International is trading at ~$31.6. It implies ~26% upside at its average target price. The mean target price, surveyed among the sell-side analysts, for Weatherford International (WFT) is ~$7.5. Currently, Weatherford International is trading at ~$5.9. It implies ~27% upside at its mean target price. Read Will Weatherford’s Debt Repayment Plan Include Asset Sales? to learn more about Weatherford International.

To learn more about the OFS industry, read The Oilfield Equipment and Services Industry: A Primer.