A Look at Chevron’s Refining Margin Trends

Chevron’s refining capacity Before we analyze Chevron’s (CVX) refining margin trends, le’s quickly look at its refining capacity. Chevron’s total refining capacity stands at 1.8 MMbpd (million barrels per day). Most of Chevron’s capacity, around ~1 MMbpd, is in the United States. In the international arena, Chevron has combined refining capacity of 0.3 MMbpd in South […]

March 23 2017, Updated 10:36 a.m. ET

Chevron’s refining capacity

Before we analyze Chevron’s (CVX) refining margin trends, le’s quickly look at its refining capacity. Chevron’s total refining capacity stands at 1.8 MMbpd (million barrels per day). Most of Chevron’s capacity, around ~1 MMbpd, is in the United States. In the international arena, Chevron has combined refining capacity of 0.3 MMbpd in South Africa, Thailand, and Canada. Chevron’s equity shares in affiliates amount to a capacity of 0.5 MMbpd, of which 0.4 MMbpd is in South Korea. Peers ExxonMobil (XOM), BP (BP), and Royal Dutch Shell (RDS.A) have refining capacity of 5.1 MM bpd, 1.8 MM bpd, and 3.1 MM bpd, respectively.

Chevron’s refining margin trends

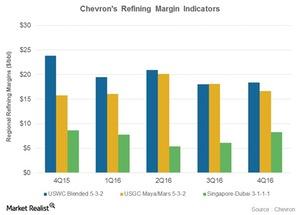

The regional refining margins of where Chevron’s refineries operate are an indicator of Chevron’s margin performance. Chevron has refineries in the US West Coast Blended 5-3-2, US Gulf Coast Maya/Mars 5-3-2, and Singapore-Dubai 3-1-1-1 regions.

On a sequential basis, the narrowing of the US Gulf Coast Maya/Mars margin was partially offset by US West Coast Blended and Singapore-Dubai margin expansion. In 4Q16, the US West Coast Blended and Singapore-Dubai expanded 2% and 37% QoQ (quarter-over-quarter) to $18.40 and $8.30 per barrel, respectively. However, the US Gulf Coast Maya/Mars margin narrowed 8% QoQ to $16.60 per barrel.

However, Chevron’s yearly margin trend was the opposite of its sequential trend. On a yearly basis, the US Gulf Coast Maya/Mars margin expanded, while the US West Coast Blended and Singapore-Dubai margins contracted. If you’re looking for exposure to integrated energy sector stocks, you could consider the iShares North American Natural Resources ETF (IGE), which has a ~21% exposure to the industry.