Why Institutional Investors Seem Bullish on MLPs in 2017

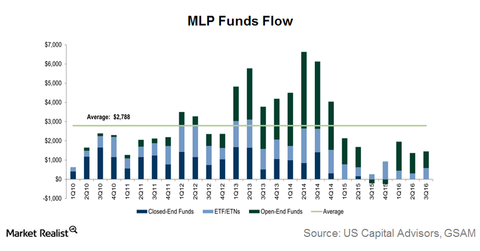

MLP funds’ capital inflow recovered slightly in 2016 compared to their levels during the second half of 2015.

Jan. 9 2017, Updated 7:36 a.m. ET

MLP funds market overview

MLP funds’ capital inflow recovered slightly in 2016 compared to their levels during the second half of 2015. However, the overall capital inflow is still lower compared to the approximate seven-year average of $2.8 billion.

Open-ended funds

The share of open-ended funds in total capital inflow is higher compared to funds such as ETFs and ETNs. The advantage of open-ended funds is active management. In the current volatile commodity price environment, active management should be preferable to passive strategies of exchange-traded products.

However, this comes with a price in terms of higher expenses. This brings down overall fund returns, and the effect is magnified when MLPs are not doing well.

Exchange-traded products

Open-ended funds are followed by passively managed exchange-traded products in terms of MLP funds flow. These include exchange-traded funds and exchange-traded notes. ETFs and ETNs track the performance of MLP indexes. MLP ETNs currently make up 35% of all US ETNs by market cap.

ETNs are similar to ETFs, but they are structured as a debt security issued by an underwriting bank. ETNs have a maturity date and are backed by the credit of the issuer. This means ETNs have credit risk in addition to market risk.

Two of the most well-known MLP ETFs and ETNs are the Alerian MLP Index ETF (AMLP) and the JPMorgan Alerian MLP Index ETN (AMJ). Enterprise Product Partners (EPD) and Energy Transfer Partners (ETP) are the top holdings of AMLP and AMJ.

Why institutional investors are bullish

Institutional investors seem to have bullish outlook for MLPs in 2017. Tortoise Capital Advisors recently launched a fund focused on North American Energy Infrastructure.

Brian Kessens, a portfolio manager at Tortoise Capital Advisors, noted on January 4, 2017, “We believe the current investment opportunity is particularly attractive given valuations, industry fundamentals and the industry growth trends.”

Kessens added, “This growth potential starts with energy production leading to increased energy transportation needs, including exports of low cost energy from the United States to the rest of the world.”