How Would Higher Inflation Impact Small Caps?

Higher inflation rates suggest that the economy might be improving. It’s good for small caps. They tend to outperform large caps during economic upturns.

Jan. 4 2017, Published 12:04 p.m. ET

Higher inflation rates could impact small caps

With oil prices slowly starting to rise, inflation rates will also likely rise. Trump’s proposed aggressive spending proposals are driving inflation expectations higher. Whether that’s a positive for small caps or not depends on whether they can pass higher rates on to consumers. Since they’re small in size, they usually don’t have that power. As a result, it could be negative for them. Inflation rose to a two-year high of 1.7% in November.

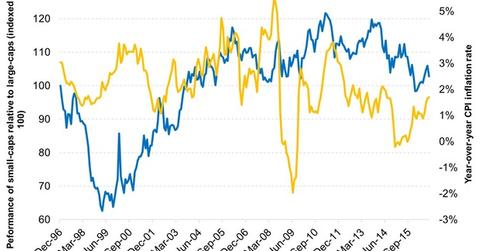

The above graph compares the year-over-year CPI (consumer price index) inflation rate with the performance of small caps, relative to large caps, over the last 20 years. As you can see, inflation rates don’t determine the path of small caps as much as interest rates or credit spreads. Over the last 20 years, the two have had a correlation of -0.1. It suggests that higher inflation could have a slightly negative impact on small caps. Large caps are usually in a better position to pass higher costs on to the customers.

Improving US economy

Higher inflation rates usually suggest that the economy might be improving. It’s positive for small caps.

Small caps (IWM) (VTI) tend to outperform large caps (OEF) during economic upturns. They have more scope for growth than the latter. While economic growth slowed down over the last few quarters, it’s showing some signs of recovery. The second graph shows the ISM manufacturing composite and the non-manufacturing composite. A number above 50 means that the sector is generally expanding. As the graph shows, both indices have been heading north.

The labor market seems to be booming. There were 178,000 jobs added in November. Also, wage growth is slowly accelerating. The GDP was revised to 3.2% for 3Q16. Meanwhile, consumer sentiment remains high. The University of Michigan’s consumer sentiment rose to 98 in December—the highest in two years.

All of this points to an improving economy, which bodes well for small-cap stocks.