Inside Water Utilities’ Historical Dividends and Growth

US water utilities have distributed fair dividends for the past few years American Water Works’ dividend growth during the past five years stands at 10%.

Nov. 17 2016, Updated 10:04 a.m. ET

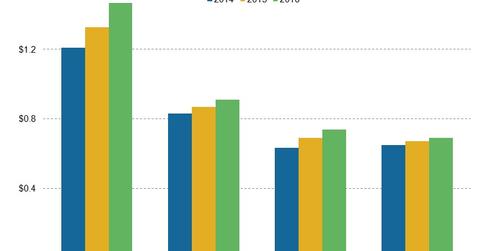

Dividend per share

US water utilities (FIW) have distributed fair dividends for the past few years. For example, American Water Works’ (AWK) dividend growth during the past five years stands at 10%.

But AWK’s earnings are expected to rise by ~8% annually, which should contribute to stable future dividend growth. So far in 2016, AWK has paid $1.09 per share in dividends.

In the past five years, WTR’s dividend has risen 8%, while CWT’s dividend showed a 2.3% rise, compounded annually. American States Water’s (AWR) dividend has grown by 10.7%, compounded annually during the past five years.