Jacobs Engineering Posts the Highest Annual Free Cash Flows

Jacobs Engineering Group declared its 4Q16 and fiscal 2016 results on November 22. It reported adjusted EPS (earnings per share) of $0.77.

Nov. 23 2016, Published 12:51 p.m. ET

Jacobs Engineering declared its 4Q16 earnings

Jacobs Engineering Group (JEC) declared its 4Q16 and fiscal 2016 results on November 22. It reported adjusted EPS (earnings per share) of $0.77. It met consensus estimates compiled by Thomson Reuters. Jacobs Engineering reported an adjusted EPS of $0.80 in 4Q15. Its earnings results were received favorably by investors. The stock closed 2.3% higher at $59.32 on November 22.

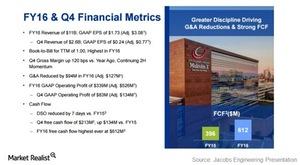

Performance in fiscal 2016

Jacobs Engineering has significant exposure to oil and gas (XOP) and mining (PICK) end markets. These markets fell quite a bit in the last two years. The company’s performance in fiscal 2016 was impacted negatively by competitive pricing pressures and weak demand in some of its business lines. In light of these business realities, the company’s revenue in fiscal 2016 fell 9.5% to $11 billion. Its adjusted EPS was flat at $3.08 due to a lower share count and restructuring initiatives that led to a fall in selling, general & administrative expenses by more than 9%. The adjusted EPS was slightly above the mid-point of the initial guidance on its fiscal results. At $612 million, the company’s free cash flows were the highest in its history this year. Jacobs Engineering managed to achieve its free cash flow position by focusing on accounts receivables. The company’s days of sales outstanding improved by seven days over the last year. Days of sales is a ratio of accounts receivables to net credit sales. Higher days of sales imply that a company is taking longer to collect money on the products sold to its customers.