Jacobs Engineering Group Inc

Latest Jacobs Engineering Group Inc News and Updates

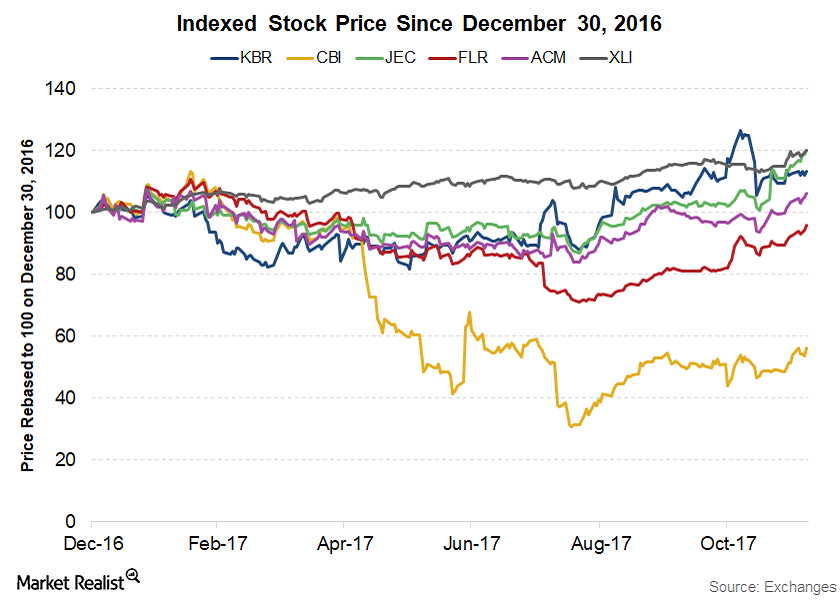

KBR Stock: Performance and Outlook

KBR has an assorted mix of business portfolios, which helps it combat cyclicality associated with any single market.

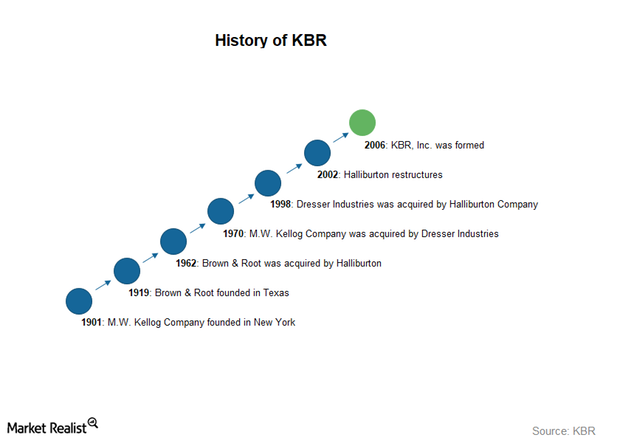

An Introduction to KBR

KBR (KBR), headquartered in Houston, Texas, is a comprehensive professional service and technology provider.

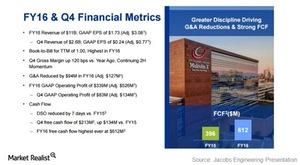

Jacobs Engineering Posts the Highest Annual Free Cash Flows

Jacobs Engineering Group declared its 4Q16 and fiscal 2016 results on November 22. It reported adjusted EPS (earnings per share) of $0.77.