How Any Huawei Problems Affect Juniper Networks

Huawei’s revenue in its Routing segment rose 15.3% YoY in 2Q16. It now accounts for 18.9% of the total router market.

Oct. 13 2016, Updated 10:04 a.m. ET

Revenue growth and market penetration

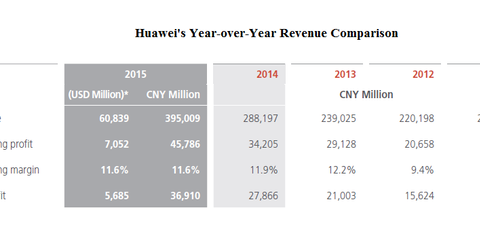

Huawei is China’s (FXI) leading information and communication technology (or ICT) solutions provider. Its ICT products and services are used in more than 170 countries. The company has more than 170,000 employees, and its annual revenue touched $60 billion in 2015. Huawei’s revenue growth, as you can see in the table below, has been impressive over the last five years.

Revenue rose 37.2%, 20.5%, 8.6%, and 7.8% YoY (year-over-year) in 2015, 2014, 2013, and 2011, respectively, on a constant currency basis.

Companies losing share to Huawei in the routing and switching spaces

As we saw in the previous parts of this series, Huawei’s revenue in its Routing segment rose 15.3% YoY in 2Q16. It now accounts for 18.9% of the total router market. Its revenues rose 44.0% YoY in 2Q16 in its Switching segment. According to UBS analyst Steve Milunovich, Huawei has targeted markets in China, Russia, and Africa, the geographies where peer companies Juniper Networks (JNPR) and Cisco (CSCO) don’t have a strong presence.

Huawei has reportedly increased R&D (research and development) expenses in its Internet Infrastructure segment. Analysts will be looking closely at the company’s performance in Europe over the next few quarters. Milunovich noted, “We believe Juniper could be more vulnerable than Cisco given a limited product portfolio.”

According to Milunovich, Cisco gained market share of 330 bps (basis points) in North America compared to Europe-based (FEP) Nokia (NOK) and Juniper in 2Q16 in the routing space. However, Cisco lost 720 bps of market share in the Asia-Pacific region to Huawei and Nokia.