How Did Boston Beer Perform in 3Q16?

Boston Beer (SAM) has a market cap of $2.0 billion. It fell 2.7% to close at $156.25 per share on October 20, 2016.

Oct. 21 2016, Published 2:01 p.m. ET

Price movement

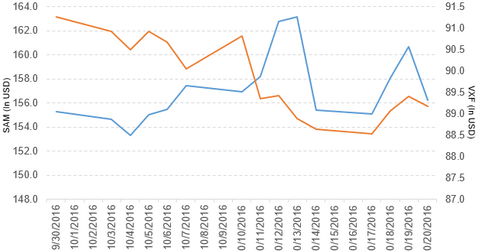

Boston Beer (SAM) has a market cap of $2.0 billion. It fell 2.7% to close at $156.25 per share on October 20, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -4.3%, 3.4%, and -22.6%, respectively, on the same day.

SAM is trading 0.56% above its 20-day moving average, 8.1% below its 50-day moving average, and 8.9% below its 200-day moving average.

Related ETF and peers

The Vanguard Extended Market ETF (VXF) invests 0.04% of its holdings in Boston Beer. The ETF tracks a market-cap-weighted version of the S&P Total Market Index, excluding all S&P 500 stocks. The YTD price movement of VXF was 7.5% on October 20.

The market caps of Boston Beer’s competitors are as follows:

Performance of Boston Beer in fiscal 3Q16

Boston Beer reported fiscal 3Q16 net revenue of $253.4 million, a fall of 13.5% compared to $293.1 million in fiscal 3Q15. The company’s gross profit margin and operating margin fell 84 bps (basis points) and 93 bps, respectively, in fiscal 3Q16 compared to the prior year’s period. The fall in gross margin was due to product mix effects and unfavorable fixed cost absorption. However, the fall was offset by cost savings initiatives in the breweries and a rise in price. It sold 1.1 million barrels in fiscal 3Q16, a fall of 11.9% compared to fiscal 3Q15.

Its net income and EPS (earnings per share) fell to $31.5 million and $2.48, respectively, in fiscal 3Q16 compared to $38.6 million and $2.85, respectively, in fiscal 3Q15.

Boston Beer’s cash and cash equivalents fell 17.9%, and its inventories rose 1.2% in fiscal 3Q16 compared to fiscal 4Q15. Its current ratio and debt-to-equity ratio fell to 1.9x and 0.39x, respectively, in fiscal 3Q16 compared to 2.0x and 0.40x, respectively, in fiscal 4Q15.

Projections

Boston Beer has made the following projections for fiscal 2016:

- EPS of $6.30–$6.70

- gross margin of 50.0%–52.0%

- effective tax rate of ~36.0%

- depletion and shipments percentage change of -6.0% to -2.0%

The company has made the following projections for fiscal 2017:

- gross margin of 51.0%–53.0%

- effective tax rate of ~36.3%

- depletion and shipments percentage change in the minus low single digits to the positive low single digits

- capital spending of $40 million–$60 million

In the next part, we’ll look at Pool Corporation (POOL).